In the world of investing and trading, understanding the dynamics between bulls and bears is crucial. Bulls represent investors who believe that the market will rise, while bears are those who expect it to fall. This article explores the concept of bulls, their significance in financial markets, and how they influence investment strategies.

What Are Bulls?

Bulls are optimistic investors who anticipate that the price of an asset will increase over time. They buy assets with the expectation that they will sell them at a higher price in the future. Bulls are often associated with bull markets, which are characterized by rising prices and investor confidence.

Characteristics of Bulls

- Optimism: Bulls believe in the upward trend of the market.

- Long Positions: They typically hold long positions, meaning they buy assets expecting them to appreciate.

- Risk Tolerance: Bulls are willing to take on more risk in pursuit of higher returns.

The Role of Bulls in Financial Markets

Bulls play a significant role in driving market trends. Their buying activity can lead to increased demand for assets, which in turn pushes prices higher. This creates a positive feedback loop where rising prices attract more bulls, further fueling the upward trend.

Bull Market Indicators

- Rising Prices: One of the most obvious signs of a bull market is a consistent increase in asset prices.

- Increased Trading Volume: Higher trading volumes indicate greater investor participation and confidence.

- Economic Growth: Strong economic indicators, such as low unemployment and high consumer spending, often accompany bull markets.

How Bulls Influence Investment Strategies

Investors and traders use various strategies to capitalize on bull markets. These strategies can range from long-term investments in growing companies to short-term trading based on technical analysis.

Common Bull Market Strategies

- Buy and Hold: Investors purchase assets and hold them for the long term, benefiting from the overall upward trend.

- Technical Analysis: Traders use charts and indicators to identify potential entry and exit points in a bull market.

- Diversification: Spreading investments across different asset classes can help mitigate risks during market fluctuations.

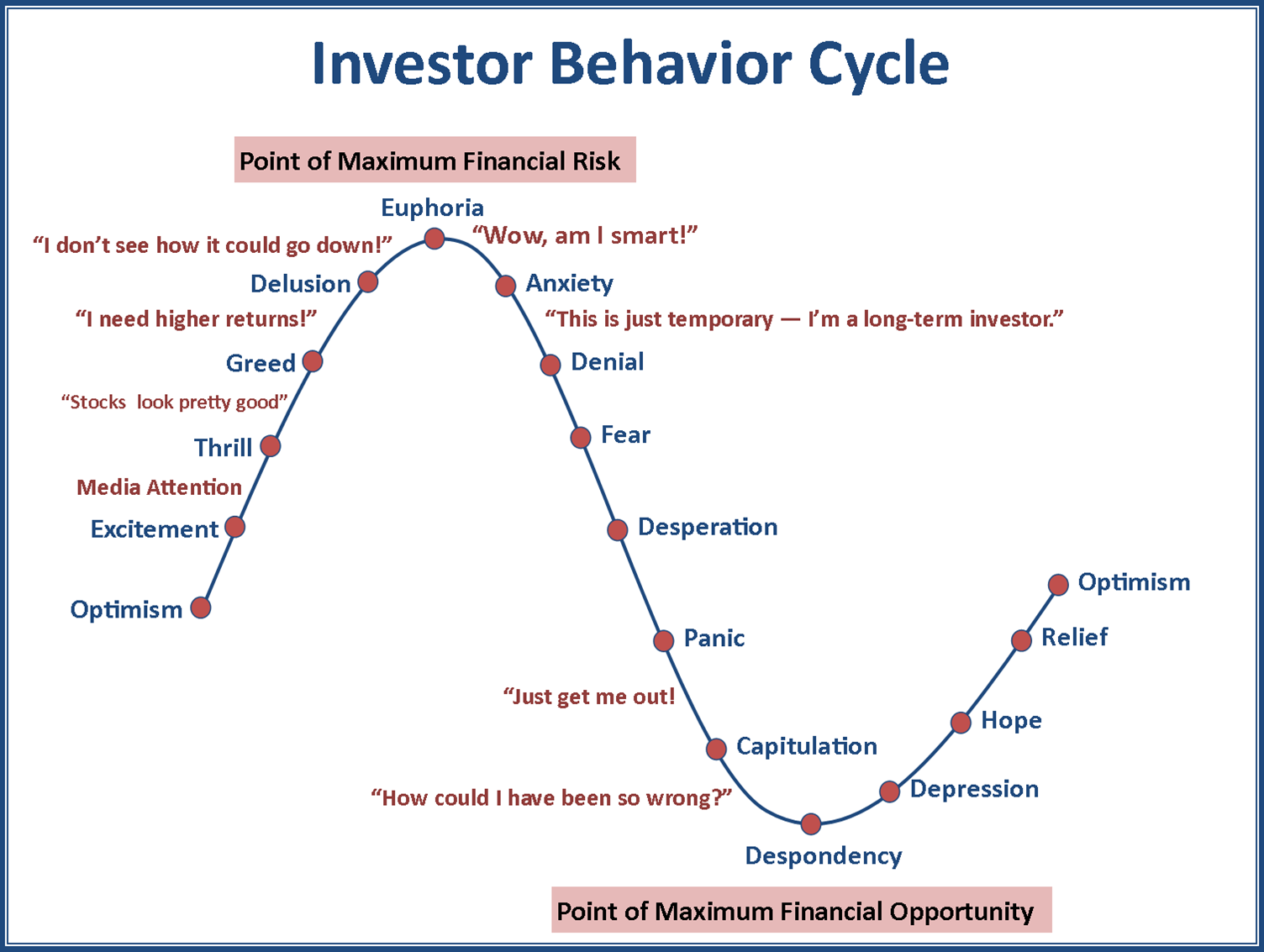

The Psychology of Bulls

Understanding the psychology behind bull behavior is essential for successful investing. Bulls are driven by optimism and a belief in the future value of assets. This mindset can lead to both opportunities and challenges in the market.

Key Psychological Factors

- Confidence: Bulls are confident in their ability to predict market movements.

- Fear of Missing Out (FOMO): The fear of missing out on potential gains can drive bulls to invest aggressively.

- Herd Mentality: Bulls may follow the crowd, leading to rapid price increases and potential bubbles.

Risks Associated with Bulls

While bulls can benefit from rising markets, there are inherent risks involved. Market corrections, economic downturns, and unexpected events can quickly turn a bull market into a bear market.

Potential Risks

- Market Volatility: Sudden price drops can erode profits and lead to losses.

- Overvaluation: Assets may become overvalued, making them vulnerable to corrections.

- Economic Downturns: A recession or other economic challenges can reverse the bullish trend.

Conclusion

Bulls play a vital role in shaping financial markets. Their optimism and buying activity can drive prices higher, creating opportunities for investors and traders. However, it’s essential to understand the risks associated with bull markets and to develop strategies that align with your investment goals.

By staying informed and adapting to market conditions, investors can navigate the complexities of bull markets and make informed decisions. Whether you’re a seasoned trader or a new investor, understanding the dynamics of bulls is key to success in the financial markets.

More Stories

How to Claim Your Joy in League of Legends: A Step-by-Step Guide

What is WSET? A Comprehensive Guide to Wine Education

How Will VA Compensation Be Affected by a Government Shutdown?