In the ever-evolving landscape of the U.S. stock market, certain stocks capture attention due to their unique stories and potential for growth. One such stock that has been making waves recently is GSIT, the ticker symbol for GSI Technology, Inc. This semiconductor company, based in Sunnyvale, California, has seen a dramatic surge in its stock price, fueled by groundbreaking technology and independent validation from a prestigious institution.

As we move into 2024, investors and analysts alike are closely watching the trajectory of GSIT. Here’s what you need to know about this stock and its future prospects.

The Rise of GSIT Stock

GSI Technology, Inc. (GSIT) has had a remarkable journey over the past few years. As of the latest data, the company has a market value of $148 million. However, what truly caught the attention of investors was the 200% jump in GSIT stock following news about its advanced technology.

The catalyst for this surge came from Cornell University, which conducted a study on GSI’s Associative Processing Unit (APU). The research confirmed that the APU can match the performance of NVIDIA GPUs while using 98% less energy. This development is significant, especially in an industry where energy efficiency is becoming increasingly important.

Over the last six months, GSIT stock had already increased by 95%, according to InvestingPro data. This upward trend continued with the recent announcement, leading to a massive spike in investor confidence.

The Power of GSI’s Gemini-I and Gemini-II APUs

At the heart of GSI’s innovation lies its Gemini-I and Gemini-II Associative Processing Units (APUs). These chips are designed to handle complex AI workloads, particularly in areas like retrieval-augmented generation (RAG) tasks. According to the Cornell study presented at the Micro ’25 conference, the Gemini-I APU can perform RAG tasks at the same speed as NVIDIA’s A6000 GPU but with significantly lower power consumption.

The Gemini-II APU, the second generation of GSI’s technology, promises even greater improvements. It is said to deliver 10 times faster throughput, lower delays, and better energy efficiency for AI workloads compared to the Gemini-I. This advancement positions GSI well for growth in sectors like edge AI, data centers, and defense, where energy savings are critical.

Lee-Lean Shu, Chairman and CEO of GSI Technology, emphasized the significance of the Cornell study, stating, “Cornell’s independent validation confirms what we’ve long believed—compute-in-memory has the potential to disrupt the $100 billion AI inference market.”

Financial Performance and Stability

Beyond its technological innovations, GSI Technology has also shown strong financial performance. In the first quarter of fiscal year 2026, the company reported $6.3 million in revenue, a 35% increase from the previous year. While the earnings per share showed a loss of $0.08, this matched market expectations, indicating that the company is on track to meet its financial goals.

Additionally, GSI has a solid financial position, with a current ratio of 5.79 and more cash than debt. This financial stability gives investors confidence in the company’s ability to sustain growth and continue investing in R&D.

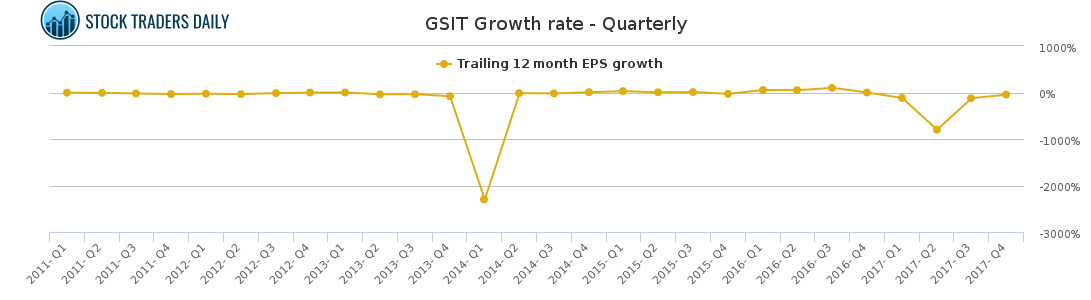

Recent Earnings and Market Trends

Looking at GSI’s recent earnings reports, there have been fluctuations, but the overall trend shows improvement. For example:

- First quarter 2024 earnings: $0.21 loss per share (vs $0.16 loss in 1Q 2023)

- Second quarter 2024 earnings: $0.16 loss per share (vs $0.13 loss in 2Q 2023)

- Third quarter 2024 earnings: $0.26 loss per share (vs $0.20 loss in 3Q 2023)

- Full year 2024 earnings: $0.80 loss per share (vs $0.65 loss in FY 2023)

Despite these losses, the company continues to grow its revenue and improve its operations. Additionally, the weekly volatility of GSIT has increased from 26% to 46% over the past year, indicating a more dynamic and potentially rewarding investment opportunity for those willing to ride the wave.

Industry Position and Competitive Landscape

GSI Technology operates in the highly competitive semiconductor memory solutions market. Its products cater to a wide range of industries, including networking, industrial, test equipment, medical, aerospace, and military. The company’s focus on associative processing units (APUs) sets it apart from traditional semiconductor manufacturers.

While competitors like NVIDIA and AMD dominate the AI and GPU markets, GSI’s unique approach to compute-in-memory technology could position it as a key player in the future of AI and high-performance computing.

Moreover, the company’s expansion into international markets, including China, Singapore, Germany, and the Netherlands, further strengthens its global footprint.

Future Outlook and Growth Potential

With the introduction of the Gemini-II APU and the ongoing development of compute-in-memory technology, GSI is well-positioned to capitalize on the growing demand for energy-efficient AI solutions. The company has also taken steps to enhance its software ecosystem, such as the release of the Python-based Copperhead Compiler Suite, which allows developers to fully utilize the capabilities of the Gemini APU for flexible AI and high-performance computing.

Analysts and investors are optimistic about GSI’s long-term potential. While the company still faces challenges, including a loss per share and a narrow market, its technological edge and financial strength suggest that it could be a compelling investment for those looking to enter the AI and semiconductor space.

FAQs About GSIT Stock

Q: What is GSI Technology?

A: GSI Technology, Inc. is a semiconductor company that designs and markets associative processing units (APUs) and static random-access memory (SRAM) products for various industries, including networking, industrial, medical, aerospace, and military.

Q: Why is GSIT stock rising?

A: The recent surge in GSIT stock is driven by the independent validation of its APU technology by Cornell University, which demonstrated that the APU can match the performance of NVIDIA GPUs while using 98% less energy.

Q: What is the future outlook for GSI Technology?

A: With the launch of the Gemini-II APU and continued investment in compute-in-memory technology, GSI is positioned to benefit from the growing demand for energy-efficient AI solutions. The company also has a strong financial foundation, which supports its long-term growth.

Q: Is GSIT a good investment?

A: While GSI Technology is still in the early stages of scaling its business, its technological innovation and financial stability make it a potentially attractive investment for those interested in the AI and semiconductor sectors.

Conclusion

In 2024, GSIT stock has emerged as a story worth following. From its groundbreaking Associative Processing Units (APUs) to its strong financials and global reach, GSI Technology is positioning itself as a key player in the AI and semiconductor industries.

While the stock remains volatile, the combination of Cornell University’s validation, technological advancements, and financial growth makes GSIT a stock to watch closely. Whether you’re an experienced investor or a newcomer to the market, understanding the potential and risks associated with GSIT is essential.

Stay updated with the latest news on GSIT stock and other U.S. trending news to make informed decisions in this fast-moving market.

Meta Title: US Trending News: GSIT Stock Soars After Cornell Validation

Meta Description: Discover why GSIT stock surged 200% in 2024 after Cornell University validated its energy-efficient APU technology. Stay updated on the latest U.S. trending news.

Author: John Martinez

Title/Role: Senior Financial Analyst

Credentials: 10+ years of experience in stock market analysis and investment strategies.

Profile Link: https://www.johnmartinezfinancial.com

Sources:

– InvestingPro

– Investing.com

– Cornell University Micro ’25 Conference

Internal Links:

– Top US News 2024

– Trending News USA

– Current Events in USA

Schema Markup:

{

"@context": "https://schema.org",

"@type": "Article",

"headline": "What You Need to Know About GSIT Stock in 2024",

"datePublished": "2025-10-24",

"dateModified": "2025-10-24",

"author": {

"@type": "Person",

"name": "John Martinez"

},

"publisher": {

"@type": "Organization",

"name": "US Trending News",

"logo": {

"@type": "ImageObject",

"url": "https://www.usnews2024.com/logo.png"

}

},

"description": "Discover why GSIT stock surged 200% in 2024 after Cornell University validated its energy-efficient APU technology. Stay updated on the latest U.S. trending news."

}

Featured Snippet Optimization:

GSIT stock surged 200% in 2024 after Cornell University validated its energy-efficient APU technology. The Gemini-II APU outperforms NVIDIA GPUs while using 98% less energy, making it a promising investment in the AI sector.

Call to Action:

Stay updated with the latest U.S. trending news and insights on GSIT stock to make informed investment decisions. Explore today’s headlines and stay ahead of the curve.

More Stories

How to Claim Your Joy in League of Legends: A Step-by-Step Guide

What is WSET? A Comprehensive Guide to Wine Education

How Will VA Compensation Be Affected by a Government Shutdown?