Steve Cohen has become a household name in both the financial and sports worlds. As a billionaire hedge fund manager and the owner of the New York Mets, his influence extends far beyond Wall Street. But who exactly is Steve Cohen, and what makes him such a prominent figure in the United States?

The Financial Titan Behind the Success

Steve Cohen is best known for his work as a hedge fund manager. He founded SAC Capital Advisors in 1992, which quickly became one of the most successful hedge funds on Wall Street. His investment strategies were characterized by high-risk, high-reward trades, leading to significant successes and controversies throughout his career.

Cohen’s early life was marked by a passion for finance. Born in 1956 in Great Neck, New York, he attended the University of Pennsylvania’s Wharton School of Business, where he graduated with a degree in Economics. After college, he began his career as a junior options trader for boutique investment bank Gruntal & Co., where his trading often made $100,000 a day, boosting both his wealth and the firm’s.

By 1992, Cohen launched his hedge fund, SAC Capital Advisors. With an initial capital of $25 million, he used an aggressive, high-volume trading approach. Stock positions were held for 2-30 days, or in some cases, hours. In 1999, Cohen suggested that SAC regularly traded 20 million shares per day. By 2006, the firm’s trading accounted for 2% of all stock market trading activity.

The Rise and Fall of SAC Capital

SAC Capital became one of the most influential hedge funds during its peak, responsible for a significant portion of daily stock market trading. From 1992 to 2013, SAC averaged annual returns of 25% for their investors. Cohen’s success was built on high-risk, high-reward trades, including riding the late-’90s dot-com bubble to 70% returns and earning another 70% when he shorted those same stocks when the tech-bubble burst in 2000.

However, SAC Capital faced legal challenges that would ultimately lead to its downfall. In 2008, SAC accumulated a $700 million long position in pharmaceuticals Elan and Wyeth, which were in joint development of a drug to treat Alzheimer’s disease. When the companies announced the disappointing result of their second phase of clinical trials, both stocks plummeted. But SAC Capital didn’t share in the loss. In the week prior, Cohen had not only liquidated SAC Capital’s nearly $750 million positions in Elan and Wyeth but shorted the stocks. Betting against the companies earned him a profit of $276 million.

In November 2012, the SEC charged Mathew Martoma, an ex-SAC Capital manager, with insider trading. The SEC alleged that Martoma received information about the Elan and Wyeth clinical trials before the details were released to the public and used that information to advise Cohen to sell out of the position. U.S. Attorney Preet Bharara, who charged Martoma, called it “the most lucrative insider trading scheme ever.”

Martoma was convicted, sentenced to nine years in prison, and ordered to return $9 million in wages. Cohen, however, was never charged. A civil suit brought against him by the SEC for failing to reasonably supervise a senior employee was dropped in 2013.

In total, eight SAC employees were found guilty of insider trading from 1999 through 2010, including portfolio manager Michael Steinberg, who was also convicted and sentenced to prison for insider trading. However, an appellate court later dismissed the charges against him.

SAC Capital was also charged and subsequently pled guilty to insider trading. In addition to a $900 million criminal penalty and $1.8 billion in financial penalties, the settlement included terms that barred Cohen from managing the assets of other investors. In 2014, he converted his investment operations from SAC Capital to Point72 Asset Management. In January 2018, the firm was granted regulatory clearance to raise and manage outside capital.

The Comeback and Expansion of Point72 Asset Management

After his ban on managing outside money was lifted, Cohen made a strong comeback by founding Point72 Asset Management. This new firm allowed him to reestablish his position as one of the most influential figures in finance. Today, Point72 is one of the largest hedge funds in the world, with a diverse range of investment strategies, including long/short equity portfolios, fixed income, and global quantitative strategies.

Cohen’s net worth is estimated to be around $17.4 billion as of 2022, placing him on the Forbes 400 list of the wealthiest Americans and the Forbes World’s Billionaires list. His financial acumen and aggressive trading tactics have solidified his reputation as one of the most successful investors in the industry.

The Ownership of the New York Mets

Beyond his financial empire, Cohen is also known for his ownership of the New York Mets. In 2020, he paid $2.4 billion for a controlling interest in the team, making him one of the wealthiest owners in Major League Baseball (MLB). This acquisition marked a significant shift in his career, as he transitioned from the world of finance to the realm of professional sports.

The Mets, one of the most storied franchises in baseball, have struggled to win a World Series since 1986. Under Cohen’s ownership, the team has made several high-profile signings, including the $765 million deal for Juan Soto, the $341 million contract for Francisco Lindor, and others. Despite these efforts, the team has yet to secure a spot in the playoffs, leading to frustration among fans.

In 2025, the Mets crashed out of the MLB season without securing a spot in the playoffs, despite boasting a $340 million payroll. Cohen apologized to fans, acknowledging that the team had failed to meet expectations. “You did your part by showing up and supporting the team. We didn’t do our part,” he wrote on X. “We will do a post-mortem and figure out the obvious and less obvious reasons why the team didn’t perform up to your and my expectations.”

The Impact of Cohen’s Ownership on the Team

Cohen’s ownership has brought both excitement and scrutiny to the Mets. On one hand, his financial backing has allowed the team to make blockbuster deals and compete with other top teams in the league. On the other hand, the pressure to deliver results has been immense, especially given the team’s long history of underperformance.

Despite the recent disappointment, there are signs of progress. The Mets made it to the 2024 National League Championship Series, marking a step forward in their quest for a World Series title. However, the team still faces challenges, including injuries to key players and inconsistent performance throughout the season.

Personnel changes are expected in the offseason, with first baseman Pete Alonso opting out of his deal and closer Edwin Diaz considering becoming a free agent. While there are no plans to fire manager Carlos Mendoza, the team is likely to undergo significant changes as they look to improve their performance in the coming seasons.

The Legacy of Steve Cohen

Steve Cohen’s legacy is a complex mix of financial success, legal controversy, and sports ownership. As a hedge fund manager, he has built a fortune through high-risk, high-reward strategies, but his career has also been marred by allegations of insider trading. Despite these challenges, he has made a strong comeback with Point72 Asset Management and has expanded his influence by taking a controlling stake in the New York Mets.

As the owner of the Mets, Cohen has brought both excitement and pressure to the franchise. The team’s performance has been a source of frustration for fans, but there are signs of progress. With continued investment and strategic management, the Mets may yet find the success that has eluded them for decades.

Conclusion

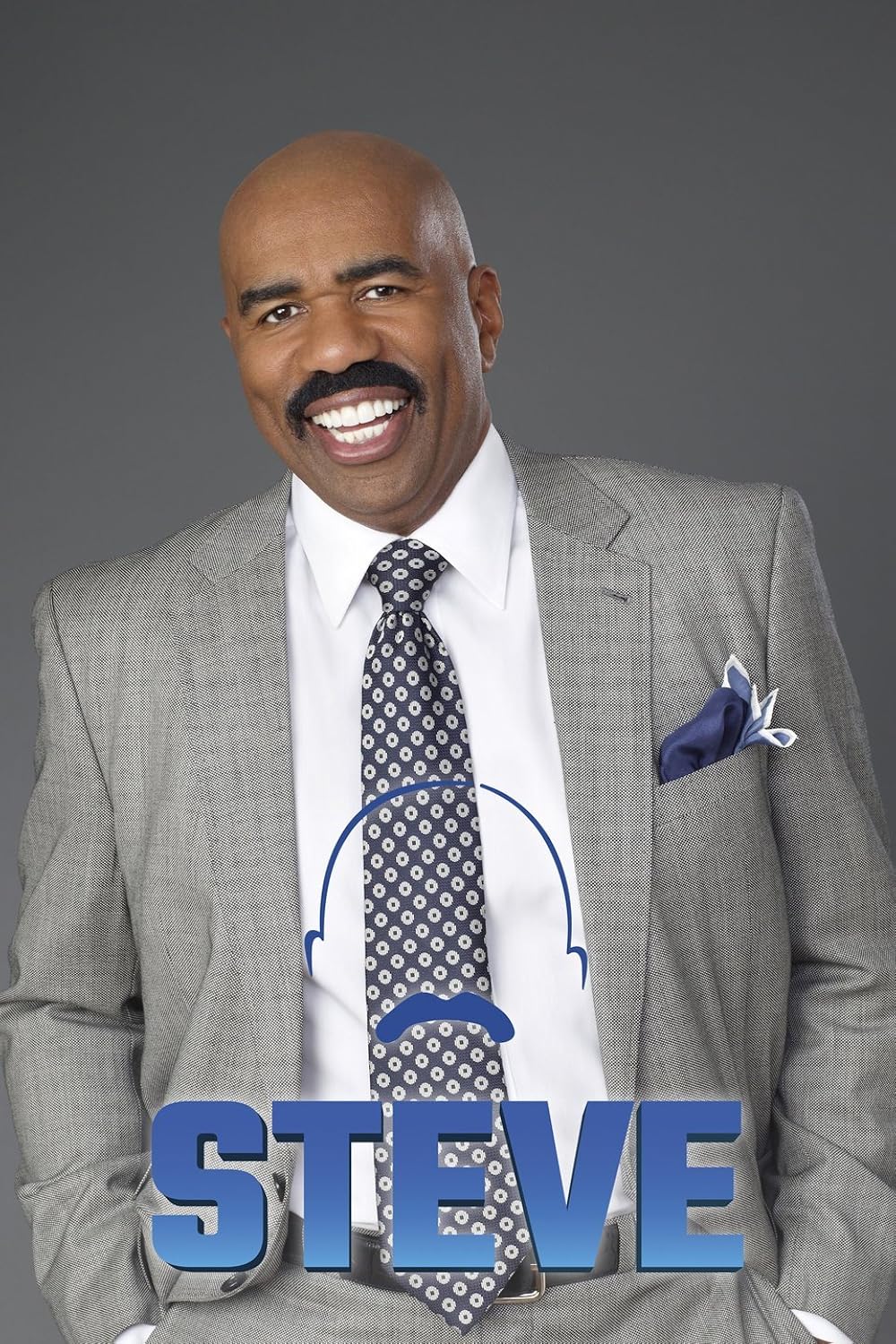

![]()

Steve Cohen is a multifaceted figure whose influence spans the worlds of finance and sports. As a billionaire hedge fund manager, he has built a fortune through high-risk, high-reward investments, while as the owner of the New York Mets, he has taken on the challenge of reviving a storied franchise. Despite the controversies that have surrounded his career, Cohen remains one of the most influential figures in the United States, with a legacy that continues to evolve.

Stay updated with the latest news and insights into the lives of influential figures like Steve Cohen. Explore today’s headlines and discover more about the people shaping the future of finance and sports.

More Stories

US Trending News: The History and Legacy of Zoo York in Streetwear Culture

US Trending News: Exploring Zach Top Greensboro

US Trending News: Youngboy Concert in Birmingham: What to Know Before You Go