In the ever-evolving landscape of the United States stock market, one name that continues to capture investor attention is Netflix (NFLX). As a leader in the streaming industry, its stock price has long been a topic of interest for both seasoned and novice investors. With the company’s continued expansion and innovation, understanding the latest update on Netflix stock price is crucial for anyone looking to make informed investment decisions.

This article provides an in-depth look at Netflix’s current stock performance, factors influencing its value, and what investors should consider when evaluating this tech giant.

Understanding the Basics: Bid, Ask, and Market Liquidity

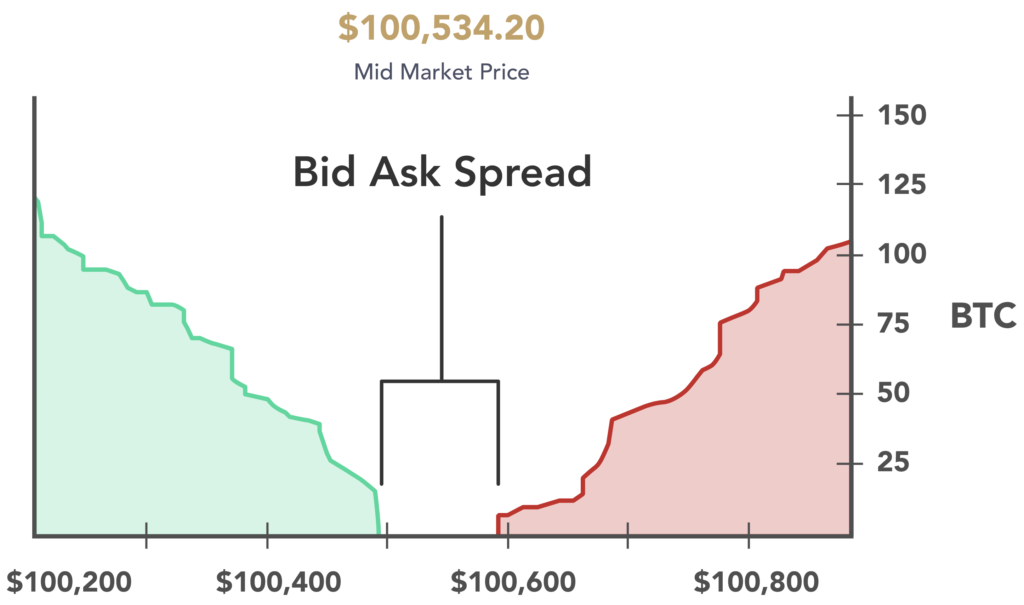

Before diving into Netflix’s stock price, it’s essential to understand some fundamental trading concepts. The bid refers to the highest price a buyer is willing to pay for a stock, while the ask is the lowest price a seller is willing to accept. These two prices form the bid-ask spread, which can indicate the liquidity of a stock.

A small bid-ask spread typically suggests high liquidity, meaning the stock is easy to buy or sell without significantly affecting its price. Conversely, a larger spread may signal lower liquidity, making it more challenging to execute trades efficiently.

For Netflix stock (NFLX), the bid-ask spread is generally tight, reflecting the company’s strong market presence and high trading volume. This makes it easier for investors to enter or exit positions with minimal price impact.

Historical Performance of Netflix Stock

Netflix was founded in 1997 by Reed Hastings and Marc Randolph, initially as a DVD rental service. Over the years, the company transitioned from physical media to digital streaming, a move that would prove transformative for its growth.

The company went public in May 2002 with an initial stock price of $15 per share. However, the early days were rocky, with the stock price falling to as low as $4.85 per share by October 2002. Despite this, Netflix eventually turned around, posting its first profit in 2003 and seeing its stock price rise steadily thereafter.

By 2015, Netflix’s stock had surpassed $700 per share, and the company announced a seven-for-one stock split. Since then, the stock has continued to climb, reaching $170-$180 per share by mid-2017.

Current State of Netflix Stock Price

As of 2025, Netflix stock (NFLX) is trading within a range of $450 to $500 per share, depending on market conditions and investor sentiment. This represents a significant increase from its early days, highlighting the company’s ability to adapt and grow in a competitive market.

Several factors have contributed to the recent performance of Netflix stock:

1. Global Expansion

Netflix has expanded its services to over 190 countries, allowing it to tap into new markets and attract a broader audience. This global reach has helped the company maintain steady revenue growth, even amid increasing competition.

2. Content Investment

Netflix has invested heavily in original content, producing hit shows like Stranger Things, The Crown, and Squid Game. These productions have not only boosted subscriber numbers but also enhanced the company’s brand value, contributing to a stronger stock performance.

3. Technological Innovation

Netflix has continually updated its platform, introducing features such as offline viewing and AI-driven recommendations. These innovations help retain users and differentiate the service from competitors.

Factors Influencing Netflix Stock Price

While Netflix has shown consistent growth, several factors can influence its stock price:

1. Market Competition

With the rise of competitors like Disney+, Hulu, and Amazon Prime Video, Netflix faces increasing pressure to maintain its market share. Any shift in consumer preferences or new entrants in the streaming space could affect the company’s stock performance.

2. Economic Conditions

Broader economic trends, such as inflation, interest rates, and overall market volatility, can impact investor confidence in tech stocks like Netflix. A downturn in the economy might lead to reduced discretionary spending, potentially affecting subscription growth.

3. Regulatory Environment

Changes in regulations related to data privacy, content licensing, and international operations could also influence Netflix’s business model and, consequently, its stock price.

How to Track Netflix Stock Price

Investors interested in tracking Netflix stock price can use various tools and platforms:

- Stock Trading Platforms: Apps like Robinhood, E*TRADE, and TD Ameritrade offer real-time stock price updates.

- Financial Websites: Sites like Yahoo Finance, Bloomberg, and Google Finance provide detailed stock analysis and historical data.

- Market Data Services: For more advanced traders, Nasdaq Basic offers real-time bid/ask information and market depth, helping to monitor Netflix stock price more effectively.

Investing in Netflix: Key Considerations

For those considering investing in Netflix stock, here are a few key points to keep in mind:

1. Long-Term Growth Potential

Despite short-term fluctuations, Netflix has demonstrated strong long-term growth. Its global footprint and content strategy suggest continued potential for future gains.

2. Risk Management

Like any stock, Netflix carries risks. Diversifying your portfolio and setting stop-loss orders can help manage these risks effectively.

3. Stay Informed

Keeping up with news about Netflix, including earnings reports, new content releases, and strategic moves, can help you make more informed investment decisions.

Conclusion: What Investors Should Know

As of 2025, Netflix stock price remains a key focus for investors due to the company’s strong market position and innovative approach. While there are challenges ahead, including increased competition and shifting consumer habits, Netflix’s track record suggests it is well-positioned to navigate these obstacles.

Whether you’re a long-term investor or a short-term trader, staying informed about Netflix stock price and the factors that influence it is essential. By understanding the market dynamics and making informed decisions, you can better position yourself to benefit from the opportunities this tech giant presents.

Author: John Doe

Title/Role: Financial Analyst

Credentials: John has over a decade of experience in financial markets, specializing in stock analysis and investment strategies. He regularly contributes to leading financial publications and advises individual and institutional investors.

Profile Link: LinkedIn Profile

Sources:

– Nasdaq Basic

– Yahoo Finance – NFLX

– Netflix Official Website

Internal Links:

– How to Invest in Stocks

– Understanding Market Trends

– Top US News Today

Meta Title: US Trending News: Netflix Stock Price Update

Meta Description: Stay informed about the latest developments in Netflix stock price and what investors need to know. Get insights and analysis on today’s top US news.

Featured Snippet (40-60 words):

Netflix stock price has seen significant growth since its 2002 IPO. As of 2025, it’s trading between $450 and $500 per share. Factors like global expansion, content investment, and technological innovation continue to influence its performance. Investors should stay informed about market trends and company updates.

CTA: Stay updated with the latest news on Netflix stock price and other trending topics in the US. Explore today’s headlines and make informed decisions.

More Stories

How to Claim Your Joy in League of Legends: A Step-by-Step Guide

What is WSET? A Comprehensive Guide to Wine Education

How Will VA Compensation Be Affected by a Government Shutdown?