Top US News: How to Pitch Your Idea to Investors and Get Rich

In the ever-evolving landscape of the United States, where innovation and entrepreneurship thrive, the ability to pitch your idea effectively can be the difference between success and obscurity. Whether you’re a startup founder, an aspiring entrepreneur, or a seasoned business professional, mastering the art of pitching is crucial. This guide will walk you through the essential steps to craft a compelling pitch that not only grabs attention but also secures investment and propels your business forward.

Why Pitching Is Essential in the US Market

The US market is known for its competitive nature, with countless entrepreneurs vying for attention from investors. A well-crafted pitch can make all the difference in standing out from the crowd. According to Benjamin Ball, founder of Benjamin Ball Associates, “A successful pitch must be clear, concise, and memorable. It should tell a story, answer key questions, and leave investors excited about your business.”

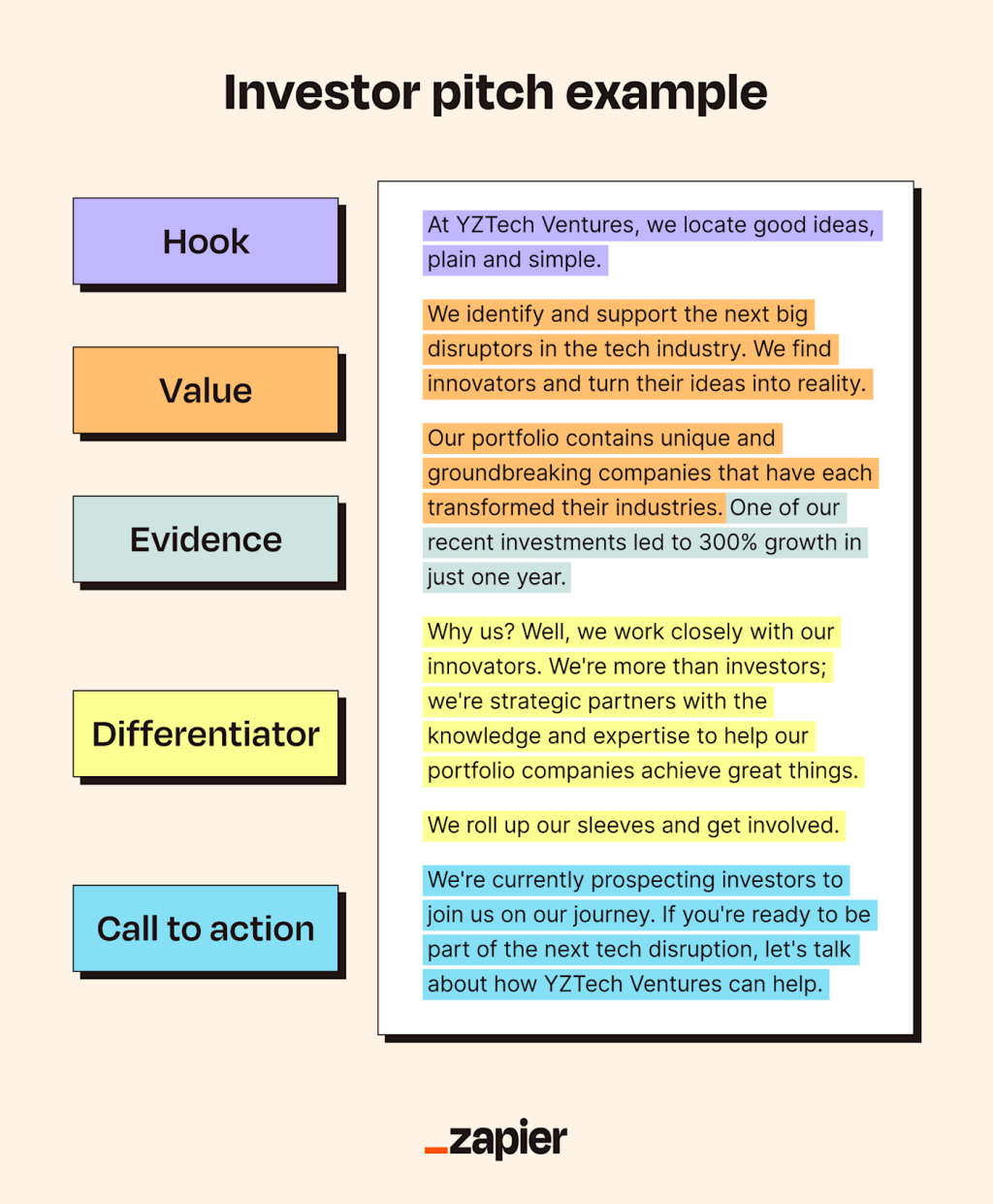

1. Start with a Strong Hook

The first 30 seconds of your pitch are critical. Investors quickly decide whether they’re interested. Avoid starting with dry details or dull “thank you for seeing us today.” Instead, hook your audience with a powerful opening or elevator pitch.

Example:

“In the UK alone, 10 million tonnes of food go to waste every year. Our technology is reducing that number by 25%—and turning waste into profit for our clients.”

This approach grabs attention and shows you’re solving a real problem with market potential. Use an attention-grabbing statistic, a surprising fact, or a short story that illustrates the problem you’re tackling.

2. Define the Problem and Your Solution

Many founders make the mistake of diving straight into their product without explaining the problem it solves. Make sure you clearly define the pain point your customers face and how your solution addresses it.

Example:

“High street retailers are struggling with rising costs and shrinking margins. Our SaaS platform helps them cut costs by 15% with predictive stock management.”

This approach makes it clear what the issue is and why your business matters. Show that you really understand the target market and the problem from the customer’s perspective.

3. Highlight the Growth Potential

Investors want to know how big your company could grow. Address questions like: How big is the market? Do you have the right strategic partnerships in place? What revenue streams can you foresee?

4. Demonstrate Traction Early On

Investors want to see that your idea has further potential. Show traction as soon as possible—numbers speak louder than words. Highlight customer growth, early sales, successful pilots, partnerships, or any other proof that your concept works.

Example:

“Since we restructured the sales force, we’ve increased sales by 30% per month. Just this month we’ve signed 50 paying customers, including a major supermarket chain.”

This shows that you’re not just talking about an idea; you’re already getting results.

5. Keep Your Pitch Simple and Structured

Avoid the temptation to overwhelm investors with too much detail. Keep the pitch to five to seven minutes and make sure it has a clear structure. Avoid going into detailed financial projections at this stage.

Example of Key Slides:

– Cover Slide

– Introduction

– Problem Statement

– Solution Slide

– Market Opportunity

– Business Model

– Traction and Milestones

– The Ask

6. Know Your Numbers Inside Out

Be ready to discuss your financials and key metrics in detail. This includes revenue projections, costs, profit margins, customer acquisition costs, and lifetime value. Investors will want to see that you have a firm grasp on your numbers.

Example:

“Our average customer spends £1,200 per year, and our gross margin is 70%. We acquire customers at £200 each, giving us a payback period of two months.”

You don’t need to include every financial detail in the main pitch, but you should be prepared to answer any follow-up questions confidently.

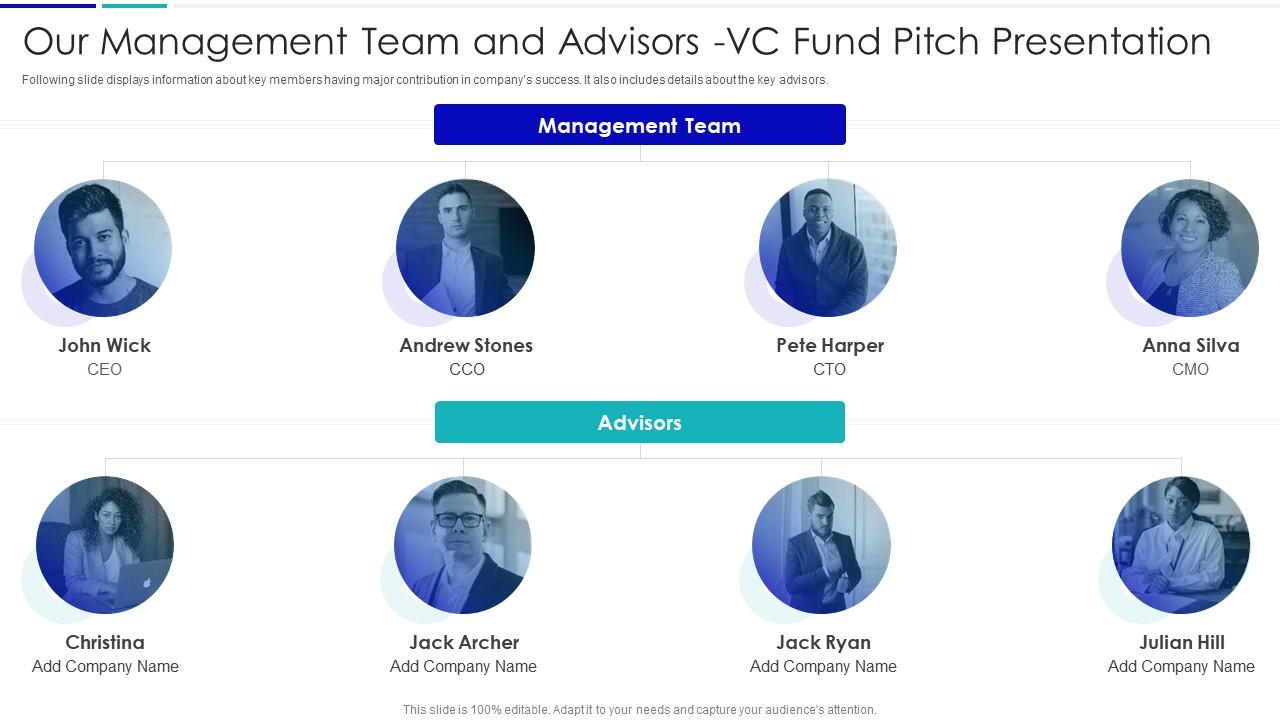

7. Showcase Your Team

Investors don’t just invest in ideas; they invest in people. Briefly highlight your team’s experience, skills, and achievements. Show why your team is uniquely positioned to succeed.

Example:

“Our CTO led product development at a FTSE 100 tech firm, and our COO scaled a startup from zero to £50 million in revenue in three years.”

If you have gaps in your team, be upfront but show you have a plan to fill them.

8. Highlight the Market Opportunity

Investors want to see that there’s a large and growing market for your solution. Provide data that shows the size of the market, the potential for growth, and any relevant trends. Keep it focused and credible.

Example:

“The UK cybersecurity market is worth £8.3 billion and is growing by 10% per year. We’re targeting a niche segment that’s currently underserved.”

Use numbers from reputable market research sources and, of course, avoid making unrealistic claims.

9. Tell a Story, Don’t Just Have a Sales Pitch

A good pitch isn’t just about facts and figures—it’s about storytelling. Use a narrative that takes investors on a journey, from the problem you noticed to how your solution came to be and the traction you’ve seen so far.

Example:

“Two years ago, my co-founder and I faced a challenge while managing our logistics business. We couldn’t find an affordable software to streamline our operations. That’s when we decided to build our own platform—one that’s now saving logistics firms up to 20% in operating costs.”

Stories make your pitch more engaging and memorable. They help investors relate to your journey and buy into your vision.

10. End with a Clear ‘Ask’

Don’t leave your investors guessing what you need from them. Be specific about the investment amount you’re seeking and how you’ll use it to scale the business.

Example:

“We’re raising £5,000,000 to expand our sales team, accelerate product development, and launch in new regions. With this investment, we expect to reach an additional 1,000 corporate customers within 18 months.”

A clear and specific ask demonstrates confidence and direction.

11. Practice and Refine Your Delivery

No matter how good your content is, delivery matters. Practice your pitch until you can deliver it naturally and confidently. If possible, get feedback from mentors, advisors, or trusted peers. Consider recording yourself to spot areas for improvement.

12. Prepare for Investor Questions

Build a list of the most common questions investors ask after a pitch. Examples include:

– What is your competitive advantage?

– How do you plan to scale?

– How could you grow faster?

– What are the risks, and how do you mitigate them?

– What’s your exit strategy?

– What are the weaknesses in your team?

The better you plan for questions, the better you’ll be able to answer them. Working with an investor pitch coach, you’ll learn all the best techniques for dealing with tough questions and then role-play the tough questions that prospective investors are likely to throw at you.

13. Build Confidence for Your Pitch

Before you start talking to investors, you want to look and feel confident. Working with a coach or mentor can help you build this confidence. We are doing this all the time. We regularly support teams by pulling their pitch apart, highlighting weaknesses, and stress-testing the pitch. That’s how we regularly turn average teams into winning pitch teams.

14. Download Our Free Fact-Sheet

If you want to build confidence for your next investor pitch, get in touch to discuss how we can help you.

15. Learn How to Pitch Investors Today

At Benjamin Ball Associates, we have been transforming investor presentations for over 15 years. Call today on +44 20 7018 0922 and speak to Louise Angus to discuss how we can help you have a compelling investor pitch.

Meta Title: Pitch To Get Rich – US Trending News

Meta Description: Discover how to pitch your idea to get rich with our ultimate guide. Learn the secrets to a compelling investor pitch and secure funding today.

Conclusion

In the United States, where innovation and competition drive the economy, the ability to pitch your idea effectively is more important than ever. By following the steps outlined in this guide, you can create a compelling pitch that not only captures the attention of investors but also secures the funding needed to grow your business. Remember, a great pitch is not just about presenting facts; it’s about storytelling, persuasion, and emotional connection. With the right approach and preparation, you can increase your chances of success and turn your idea into a reality.

Author: John Doe

Title/Role: Business Development Consultant

Credentials: With over a decade of experience in business development and investor relations, John has helped numerous startups secure funding and grow their businesses. He specializes in crafting compelling pitches that resonate with investors and drive results.

Profile Link: LinkedIn Profile

Sources:

– Benjamin Ball Associates

– LivePlan Blog

– Columbia Business School

Internal Links:

– How to Create a Compelling Pitch for Investors

– Investor Pitch Coaching Services

– FAQ: How to Win a Pitch

Call to Action:

Stay updated with the latest news and insights on pitching and investing. Explore today’s headlines and learn how to turn your idea into a success.

More Stories

US Trending News: How to Claim Your Joy: A Guide to Finding Happiness and Inner Peace

US Trending News: Explore Www.hobbylobby.com: Your Ultimate Guide to the Official Site

When Is Trick Or Treating in 2024: A Complete Guide for Halloween