Student loan debt has become a significant concern for many Americans, with over $1.7 trillion in outstanding federal student loans as of 2023. For borrowers struggling to manage their payments, the Pay As You Earn (PAYE) student loan repayment plan offers a viable solution. This income-driven repayment (IDR) plan is designed to make monthly payments more manageable by basing them on the borrower’s income and family size.

In this article, we’ll explore what the PAYE plan is, how it works, its benefits, potential drawbacks, and whether it might be the right option for you.

What Is the Pay As You Earn (PAYE) Student Loan Plan?

The Pay As You Earn (PAYE) plan is one of four major income-driven repayment plans offered by the U.S. Department of Education. It was introduced in 2012 and is available only for Direct Loans, which are federal student loans issued directly by the government.

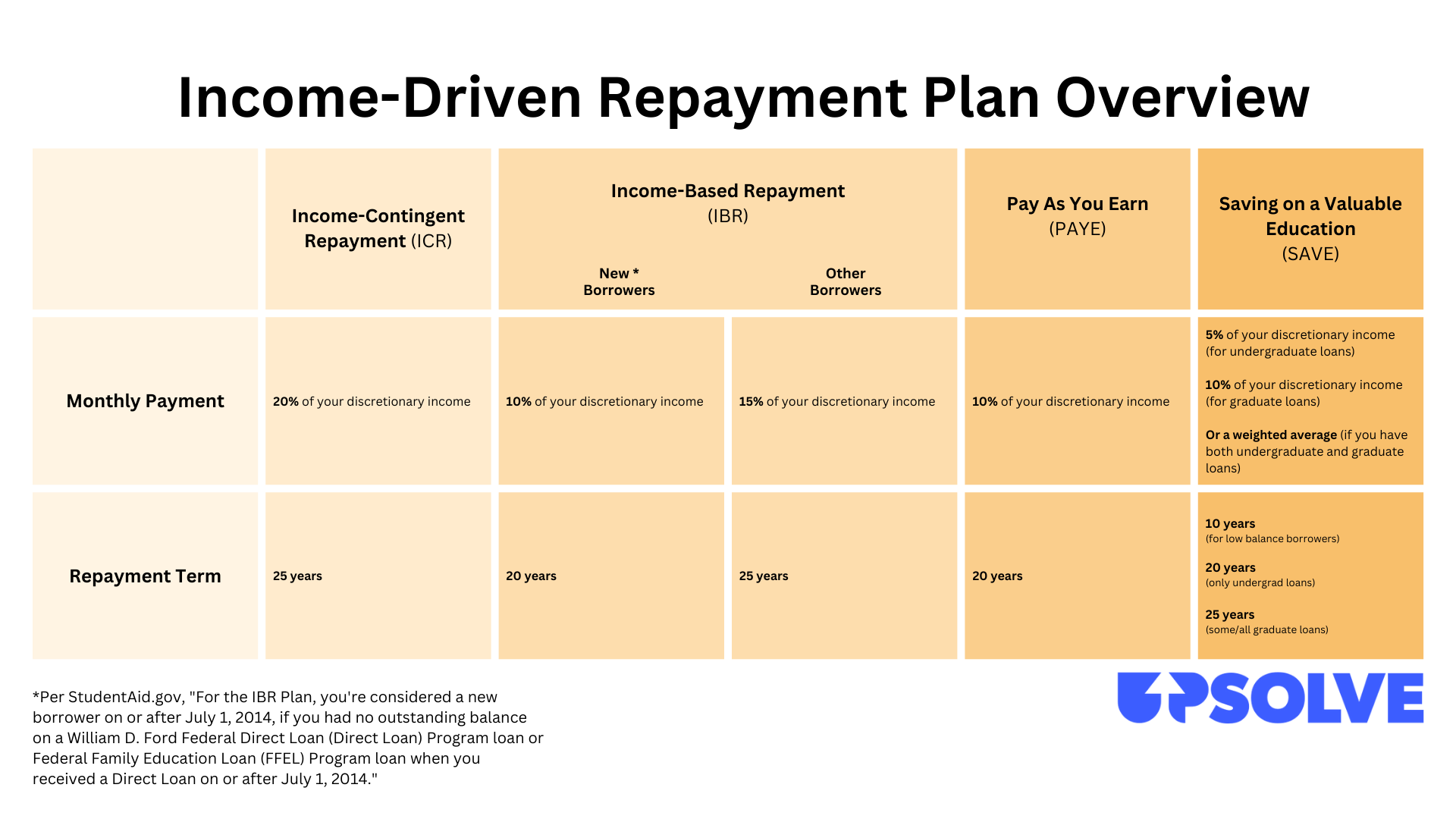

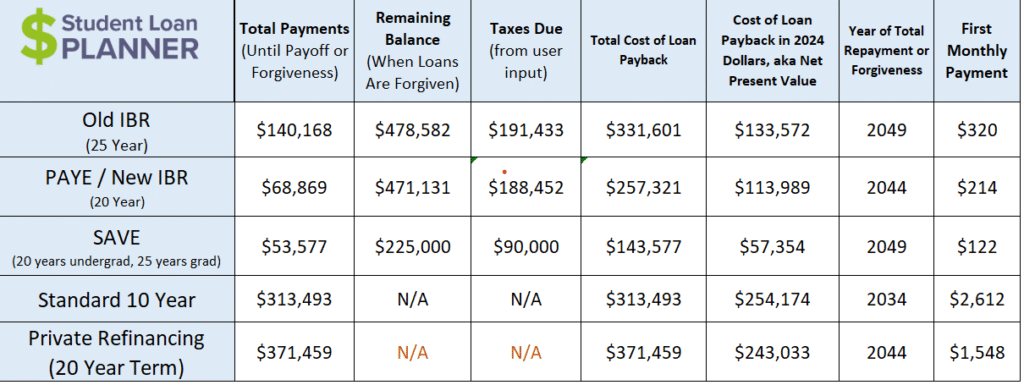

Under PAYE, your monthly payment is calculated as 10% of your discretionary income, which is defined as the amount of income you have after subtracting 150% of the federal poverty level for your family size. This makes the plan particularly beneficial for borrowers with lower incomes or those who have high student loan balances relative to their earnings.

How Does the PAYE Plan Work?

To understand how the PAYE plan works, let’s break down the key components:

1. Eligibility Requirements

To qualify for the PAYE plan, you must meet the following criteria:

– Have Direct Loans.

– Have a “partial financial hardship”—meaning your monthly payment under the standard 10-year repayment plan would exceed 10% of your discretionary income.

– Be a new borrower on or after October 1, 2007, or have had a loan disbursement before that date but not have had a balance remaining on a Direct Loan as of October 1, 2007.

Note: Parent PLUS loans are not eligible for PAYE unless they are consolidated into a Direct Consolidation Loan.

2. Monthly Payment Calculation

Your monthly payment under PAYE is based on:

– Your adjusted gross income (AGI).

– Your family size.

– The total amount of your federal student loans.

The formula is:

Monthly Payment = 10% of Discretionary Income

Discretionary income is calculated as:

AGI – (150% of the federal poverty level for your family size)

For example, if your AGI is $40,000 and you have a family of three, and the poverty line for a family of three is $23,000, your discretionary income would be $40,000 – $34,500 = $5,500. Your monthly payment would then be 10% of $5,500, which is $55 per month.

3. Repayment Term

The PAYE plan has a 20-year repayment term for undergraduate loans and a 25-year term for graduate or professional loans. After making 240 (or 300) qualifying payments, any remaining balance is forgiven.

Benefits of the PAYE Student Loan Plan

The PAYE plan offers several advantages that can make it an attractive option for borrowers:

1. Lower Monthly Payments

By tying your payments to your income, the PAYE plan ensures that your monthly payment is always affordable. This is especially helpful for borrowers with low income or those who are just starting their careers.

2. Potential for Loan Forgiveness

After 20 years (for undergraduate loans) or 25 years (for graduate loans), any remaining balance is forgiven. This can provide long-term relief for borrowers who may not be able to pay off their loans in full.

3. No Credit Score Impact

As long as you make your payments on time, your credit score will not be negatively affected. In fact, consistent payments can help improve your credit over time.

4. Interest Subsidy

During the first three years of the plan, the federal government pays all accrued interest on subsidized loans. This can prevent your loan balance from growing due to unpaid interest.

Drawbacks of the PAYE Student Loan Plan

While the PAYE plan has many benefits, there are also some potential downsides to consider:

1. Loan Balance May Grow

If your monthly payment is less than the interest that accrues, your loan balance could increase. This is known as negative amortization.

2. Taxable Loan Forgiveness

Unlike Public Service Loan Forgiveness (PSLF), the forgiveness you receive under PAYE is taxable. This means you may owe taxes on the amount of debt that is forgiven.

3. Annual Recertification Required

You must recertify your income and family size every year to remain eligible for the plan. If you miss the deadline, your payments may revert to the standard repayment plan, which could be significantly higher.

4. Limited Eligibility

Only Direct Loans are eligible for PAYE. Private student loans and certain federal loans like Parent PLUS are not eligible unless consolidated.

Who Should Consider the PAYE Plan?

The PAYE plan is best suited for borrowers who meet the following conditions:

- Have low or moderate income compared to their student loan debt.

- Are unemployed or underemployed.

- Are at risk of defaulting on their loans.

- Are eligible for Public Service Loan Forgiveness (PSLF).

If you’re unsure whether PAYE is right for you, consider using the StudentAid.gov repayment calculator to compare different options.

Alternatives to the PAYE Plan

If you don’t qualify for PAYE or prefer a different option, there are other income-driven repayment plans to consider:

- Income-Based Repayment (IBR)

- Income-Contingent Repayment (ICR)

- Revised Pay As You Earn (REPAYE)

Each plan has different eligibility requirements and payment calculations. For example, REPAYE includes all federal loans, including Parent PLUS, but has a slightly longer repayment term.

Frequently Asked Questions About the PAYE Plan

Q: Is there an income limit for the PAYE plan?

A: No, there is no strict income limit. However, your payment is based on your income and family size. If your income is low compared to your loan balance, you’ll likely benefit the most.

Q: How long do PAYE plans last?

A: These plans last until you either pay off your loan or qualify for loan forgiveness. Forgiveness typically happens after 20–25 years of qualifying payments.

Q: Will the PAYE plan hurt my credit score?

A: No, your credit score won’t be affected if you make your payments on time. In fact, it can help you avoid default, which would harm your credit.

Conclusion: Is the PAYE Plan Right for You?

The Pay As You Earn (PAYE) student loan plan is a valuable tool for borrowers facing financial challenges. By aligning your monthly payments with your income, it can reduce the burden of student loan debt and offer the possibility of long-term forgiveness.

However, it’s important to weigh the pros and cons carefully. If you’re considering PAYE, take the time to understand the requirements, calculate your potential payments, and consult with a student loan counselor if needed.

Remember, the goal is to find a repayment plan that works for your unique situation and helps you achieve financial stability.

Stay updated with the latest news and insights on student loans and financial planning.

Author

Name: Sarah Mitchell

Title/Role: Financial Analyst & Student Loan Expert

Credentials: Sarah has over a decade of experience in personal finance and student loan counseling. She specializes in helping borrowers navigate complex repayment options and make informed decisions about their financial futures.

Profile Link: SarahMitchellFinancial.com

Sources

- StudentAid.gov – Income-Driven Repayment Plans

- U.S. Department of Education – PAYE Plan Details

- Consumer Financial Protection Bureau – Student Loan Help

Related Articles

- What Is the Income-Based Repayment (IBR) Plan?

- How to Apply for Student Loan Forgiveness

- Understanding the Differences Between IDR Plans

Call to Action

If you’re struggling with student loan payments, consider exploring your options. The PAYE plan could be a great fit for your financial situation. Take the first step today and visit StudentAid.gov to learn more.

More Stories

What Is Yodo Para Tiroides and How Does It Affect Thyroid Health?

What is WSET? A Comprehensive Guide to Wine Education

US Trending News: What Are Winter Bones? A Guide to the Seasonal Trend in Bone Health