In the ever-evolving landscape of U.S. politics, property taxes have become a hot-button issue, especially in states like Florida. Governor Ron DeSantis has emerged as a prominent figure in this debate, advocating for significant changes to the state’s property tax system. This article explores DeSantis’ positions on property taxes, the potential impacts of his proposals, and the broader implications for Florida’s economy and residents.

The Political Context

Ron DeSantis, the governor of Florida, has long been vocal about his stance on property taxes. In recent years, he has pushed for measures that would significantly reduce or even eliminate property taxes for homeowners. His approach is rooted in a belief that property taxes are an unfair burden on residents, particularly those who own their homes.

DeSantis has proposed a series of constitutional amendments that would allow voters to decide on the future of property taxes in Florida. These proposals aim to cap, cut, or eliminate most property taxes, with a focus on owner-occupied housing. The governor’s vision is to make homeownership more affordable by reducing the financial strain associated with property taxes.

Key Proposals and Their Implications

The proposed amendments include several key measures:

- Elimination of Nonschool Property Taxes: This measure would remove property taxes on owner-occupied homes, effectively eliminating the tax burden for many Floridians.

- Exemptions for Seniors and Fully Insured Homeowners: These exemptions would provide relief to specific groups, such as seniors and homeowners with full insurance coverage.

- Capping Yearly Growth in Property Taxes: This proposal aims to limit the annual increase in property taxes, providing stability for homeowners.

While these proposals aim to alleviate the burden on homeowners, they also raise concerns about the potential impact on local governments and public services. Property taxes currently fund essential services such as schools, police, and fire departments. If these taxes are eliminated, local governments may need to find alternative sources of revenue, which could lead to increased sales taxes or other forms of taxation.

Revenue Concerns and Fiscal Impact

One of the primary concerns surrounding DeSantis’ proposals is the potential loss of revenue for local governments. Property taxes generate approximately $43 billion annually in Florida, with a significant portion funding public safety and education. If these taxes are eliminated, local governments may face severe budget shortfalls, leading to cuts in essential services.

Experts estimate that to offset the lost revenue, Florida would need to double its current sales tax rate from 6% to around 12%. This increase could disproportionately affect lower-income households, as sales taxes are generally regressive. Additionally, the volatility of sales tax revenue could create uncertainty for local governments, making it difficult to plan for the future.

Housing Market Effects

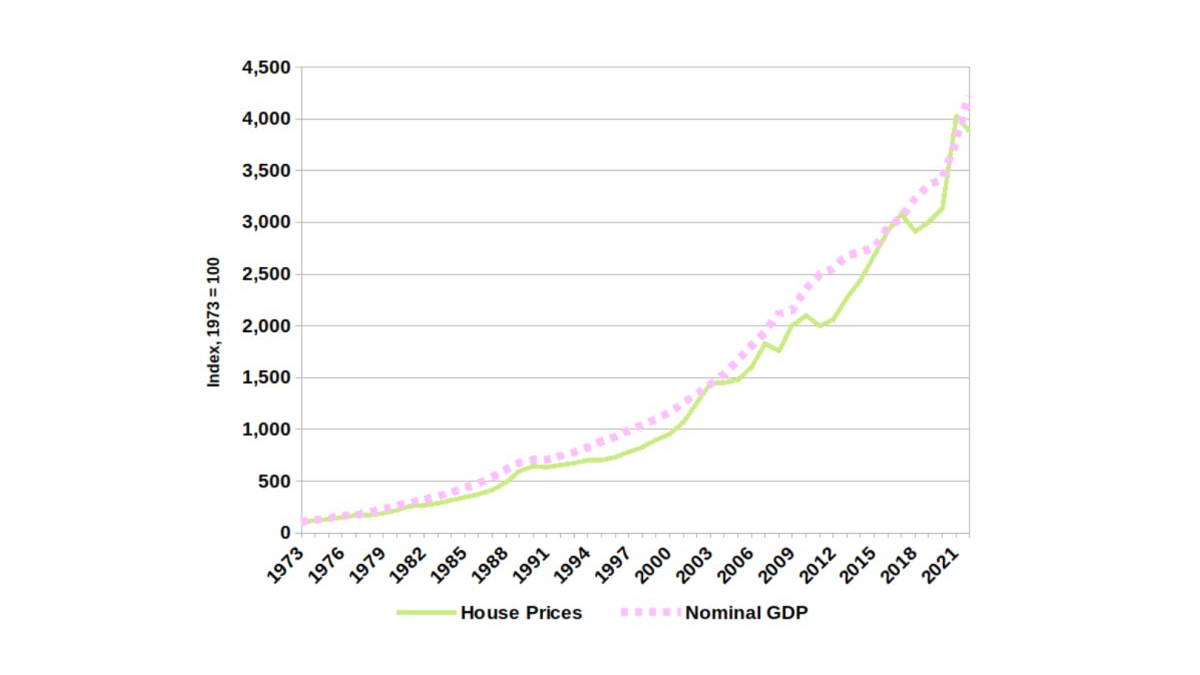

The potential impact on the housing market is another critical consideration. While eliminating property taxes could make homeownership more affordable for existing residents, it may also lead to increased demand for housing, potentially driving up home prices. This could make it more challenging for first-time homebuyers to enter the market, as higher prices could outweigh the benefits of lower property taxes.

Moreover, the shift in tax policy could alter the dynamics of the real estate market. Developers may be less inclined to invest in new housing projects if the revenue from property taxes is reduced. This could lead to a decrease in housing supply, further exacerbating affordability issues.

Political Landscape and Legislative Path

The path to implementing DeSantis’ proposals involves navigating a complex legislative process. The Florida House of Representatives has introduced multiple measures aimed at reforming property taxes, including a constitutional amendment that would allow voters to decide on the future of property taxes in the 2026 election. However, there is significant debate within the legislature about the best approach to address the issue.

Some lawmakers advocate for a sales tax reduction as an alternative to property tax elimination, while others support DeSantis’ vision of a complete overhaul of the tax system. The governor has expressed strong opposition to any plans that include sales tax cuts, arguing that they undermine his property tax reform efforts.

Public Opinion and Voter Response

Public opinion on property tax reforms is divided. While many Floridians support the idea of reducing or eliminating property taxes, others are concerned about the potential consequences for local services and the economy. A recent poll found that 68% of Florida voters prefer retaining property taxes rather than facing a doubled sales tax rate.

This divide highlights the challenges that DeSantis and his allies face in gaining widespread support for their proposals. The success of the constitutional amendment will depend on the ability of proponents to convince voters that the benefits of property tax elimination outweigh the risks.

Conclusion

Ron DeSantis’ push for property tax reform in Florida reflects a broader national conversation about the role of taxes in American society. While his proposals aim to provide relief to homeowners, they also raise important questions about the sustainability of local government finances and the potential impact on the housing market.

As Florida moves forward with its property tax reforms, it will be crucial to balance the needs of homeowners with the responsibilities of local governments. The outcome of these debates will shape the future of property taxes in the state and have far-reaching implications for residents, businesses, and the overall economy.

Stay updated with the latest news on property tax reforms and their impact on Florida’s communities. Explore today’s headlines to understand how these changes may affect your life and the future of your home.

More Stories

US Trending News: What Is ‘Spotify Trump’ and Why Is It Trending?

US Trending News: Senate Democrats and the Impact of Government Shutdowns

What You Need to Know About Relief Payment 2025