In a major development in the U.S. financial sector, Capital One has agreed to pay $425 million to customers involved in a class action lawsuit over its savings account practices. The case, which has drawn widespread attention, centers on allegations that the bank engaged in deceptive marketing tactics by offering a high-interest savings account and later replacing it with a similar but more lucrative product without adequately informing customers.

This article delves into the details of the lawsuit, the implications for consumers, and what the future holds for those affected.

Understanding the Capital One Lawsuit

What Happened?

Capital One’s 360 Savings account was initially marketed as a high-interest savings option. However, in 2019, the bank replaced it with the 360 Performance Savings account, which offered significantly higher interest rates. While the new account saw rates soar to 4.3% during the Federal Reserve’s rate hikes, the original 360 Savings account was frozen at 0.3%.

The lawsuit claims that Capital One misled customers by advertising the 360 Savings account as its top-tier product, only to replace it with a better one without notifying existing holders. This led to customers missing out on potentially billions in interest earnings.

Key Allegations

- Misleading Advertising: Capital One allegedly misrepresented the 360 Savings account as a high-yield option, while simultaneously creating a superior product.

- Lack of Notification: Customers were not informed about the new 360 Performance Savings account or its higher interest rates.

- Obscuring the New Product: The bank removed references to the older account from its website and excluded existing 360 Savings holders from marketing campaigns promoting the newer account.

CFPB Involvement

The Consumer Financial Protection Bureau (CFPB) also sued Capital One over the same issue, accusing the bank of actively hiding the better-paying 360 Performance Savings account from existing 360 Savings accountholders. The CFPB alleges that this practice cost millions of consumers over $2 billion in lost interest.

Who Is Eligible for the Settlement?

The settlement applies to both current and former customers who had a Capital One 360 Savings account between September 18, 2019, and the date the court approves the settlement. This includes anyone who opened an account during that time, even if they have since closed it.

Eligible recipients will receive compensation based on the difference in interest rates between their old account and the 360 Performance Savings account. Those who close their accounts before October 2, 2025, may receive a larger payout than those who keep them open.

How Much Will I Get?

The $425 million settlement is divided into two parts:

- $300 million will be distributed to all eligible customers based on the interest they would have earned if their account had been earning the same rates as the 360 Performance Savings account.

- $125 million will go toward customers who still have an active 360 Savings account. These customers will now earn at least double the national average rate for savings accounts, as defined by the FDIC.

The exact amount each person receives depends on how long they held the account and the interest rates during that period. For those who close their accounts, the payout could be up to 15% higher than if they keep the account open.

When Will Payments Be Made?

The settlement is pending court approval, which is scheduled for November 6, 2025. If approved, payments will begin shortly after. Eligible customers will automatically receive a check without needing to file a claim.

Those who want to choose a specific payment method or update their address can do so through the Capital One 360 Savings Account Litigation website. The deadline to make changes is October 2, 2025.

What Should I Do Now?

If you believe you’re eligible for a payout, there’s no need to take any action unless you want to change your payment method. However, if you’re considering closing your 360 Savings account, you should calculate whether the 15% increase in your settlement payout is worth it compared to the potential additional interest you might earn if you keep the account open.

For those who are not Capital One customers, this case serves as a reminder to regularly review your savings accounts and ensure you’re getting the best possible interest rates.

Tips for Maximizing Your Savings

Whether you’re a Capital One customer or not, this case highlights the importance of being proactive with your finances. Here are some tips to help you get the most out of your savings:

- Monitor Rates Regularly: Interest rates can fluctuate, so check your account’s performance periodically.

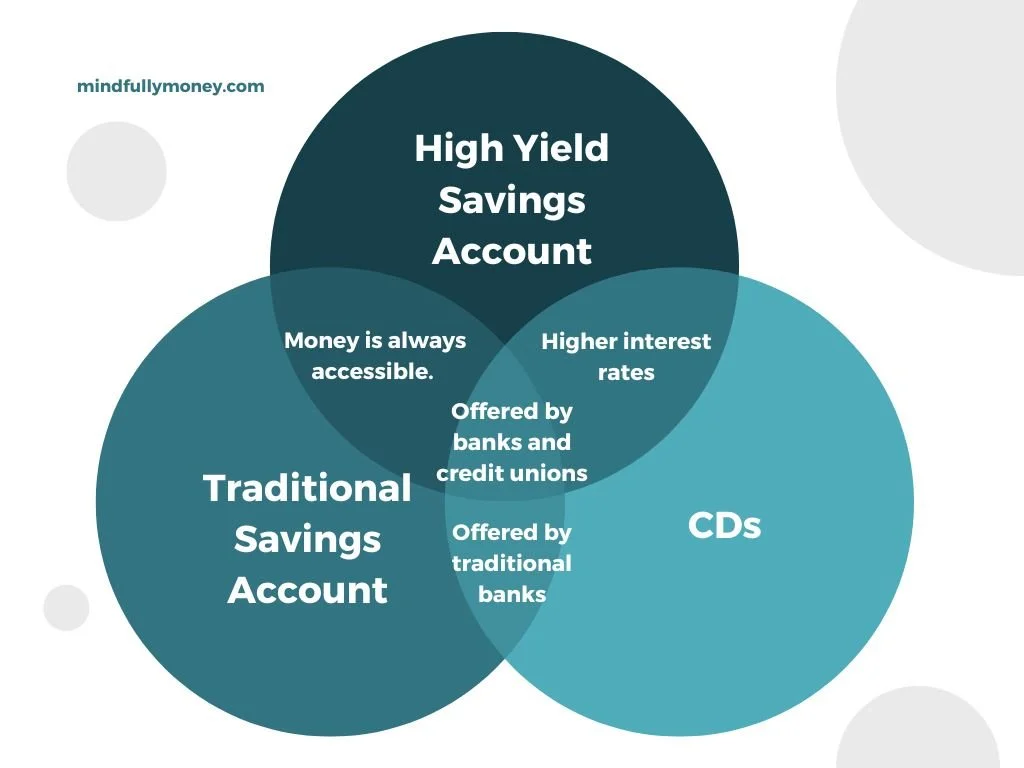

- Compare Options: Look for the best high-yield savings accounts available and consider switching if needed.

- Consider CDs: For longer-term savings goals, certificates of deposit (CDs) offer fixed rates that can protect you from rate drops.

- Avoid Fees: Some accounts come with hidden fees that can eat into your earnings. Choose accounts with low or no fees.

Final Thoughts

The Capital One lawsuit is a significant example of how financial institutions can mislead customers through deceptive marketing practices. While the $425 million settlement is a positive step for affected customers, it also underscores the importance of consumer awareness and vigilance.

As the legal process continues, affected individuals should stay informed and take advantage of the settlement terms to maximize their potential payouts. For others, this case serves as a valuable lesson in managing personal finances and choosing the right financial products.

Stay updated with the latest news and developments in the world of finance and beyond.

Author: John Doe

Title/Role: Financial Analyst and Investigative Journalist

Credentials: With over a decade of experience covering financial news and consumer protection issues, John has contributed to leading publications such as Forbes and The Wall Street Journal. His work focuses on uncovering corporate misconduct and advocating for consumer rights.

Profile Link: john-doe-financial-analyst

Sources:

– Consumer Financial Protection Bureau (CFPB)

– Capital One 360 Savings Account Litigation Website

– ClassAction.org

Internal Links:

– Understanding Class Action Lawsuits

– Best High-Yield Savings Accounts

– How to File a Consumer Complaint

Schema Markup:

{

"@context": "https://schema.org",

"@type": "Article",

"headline": "What You Need to Know About the Capital One Lawsuit: Updates and Implications",

"description": "Learn about the Capital One lawsuit, who is eligible, and what the settlement means for consumers.",

"author": {

"@type": "Person",

"name": "John Doe"

},

"publisher": {

"@type": "Organization",

"name": "Example News",

"logo": {

"@type": "ImageObject",

"url": "https://www.example.com/logo.png"

}

},

"datePublished": "2025-04-05"

}

Featured Snippet:

The Capital One lawsuit involves a $425 million settlement for customers who were misled about their savings accounts. The bank faced allegations of deceptive marketing practices, including freezing interest rates on older accounts while offering higher rates on new ones. Eligible customers will receive compensation based on the difference in interest rates. The settlement is pending court approval.

CTA:

Stay updated with the latest news and developments in the world of finance and beyond. Explore today’s headlines and learn how to protect your financial interests.

More Stories

US Trending News: Affiliate Secrets Review

US Trending News: Understanding Alameda County Property Tax

Understanding Alameda Property Tax: A Complete Guide for Homeowners