Introduction to Alameda Property Tax

Property taxes are a critical aspect of homeownership, and understanding how they work in Alameda County is essential for both current and prospective homeowners. Located in the heart of the San Francisco Bay Area, Alameda County is known for its diverse communities, from urban centers like Oakland and Berkeley to suburban areas that offer a more relaxed lifestyle. The property tax system in Alameda is governed by state laws, including Proposition 13, which significantly impacts how taxes are calculated and paid.

This guide provides a comprehensive overview of Alameda property tax, covering everything from how it’s calculated to strategies for reducing your tax liability. Whether you’re a first-time homebuyer or an experienced investor, this article will help you navigate the complexities of property taxation in Alameda.

How Alameda Property Taxes Are Calculated

Alameda County property taxes are based on the assessed value of your property. According to Proposition 13, the assessed value of a property cannot increase by more than 2% each year for tax purposes. This cap helps protect homeowners from sudden spikes in property taxes, even if the market value of their home increases rapidly.

However, there are exceptions. If the property changes ownership, the base year for calculating taxes will change. The market value at the time of the sale becomes the new base, from which the 2% annual increase is calculated. Additionally, Proposition 8 allows the county assessor to choose the lesser of the two values between the 2% yearly increase or the market value as of January 1 of the current year. This means that if the housing market dips, you may receive a tax break.

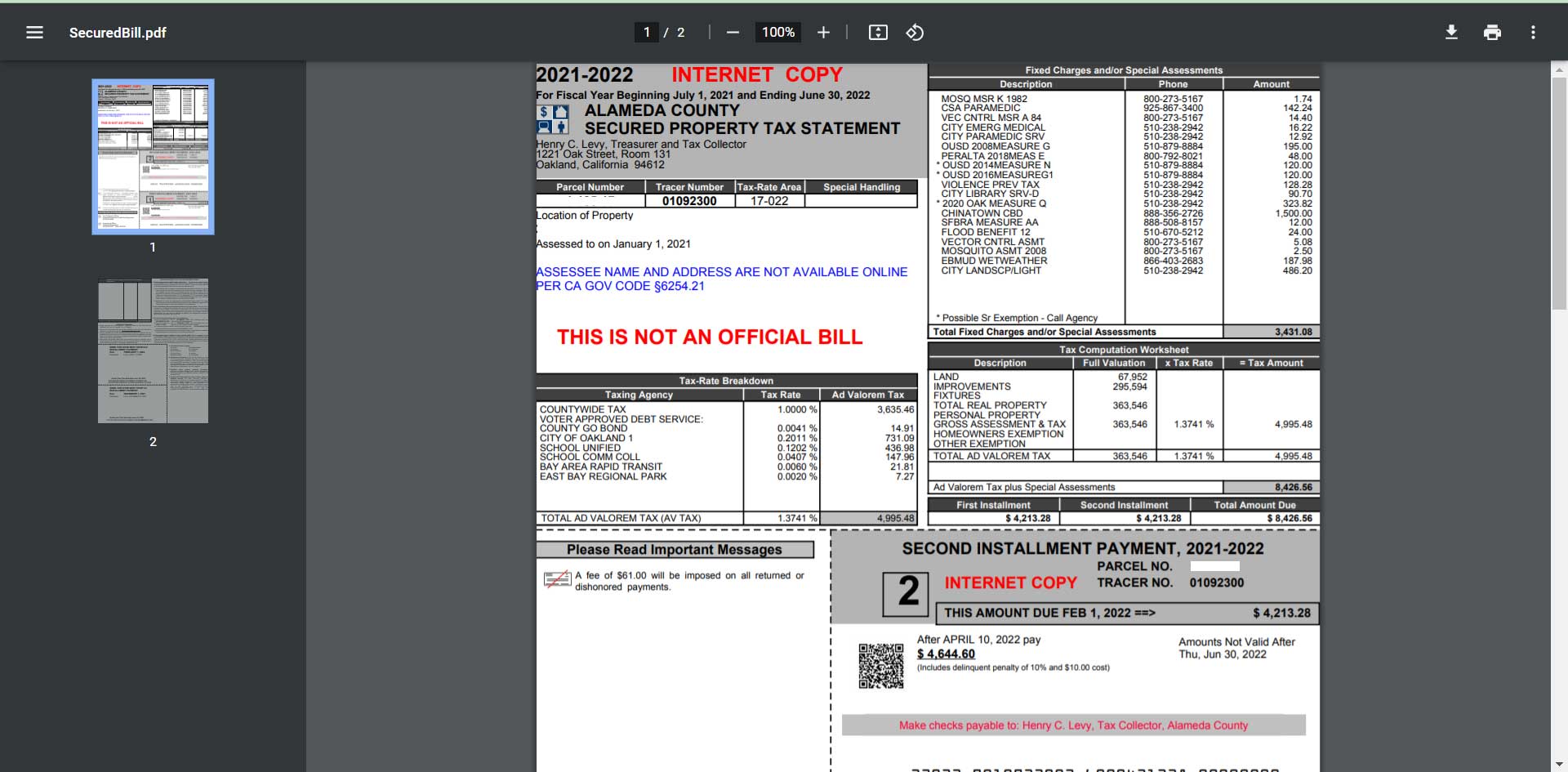

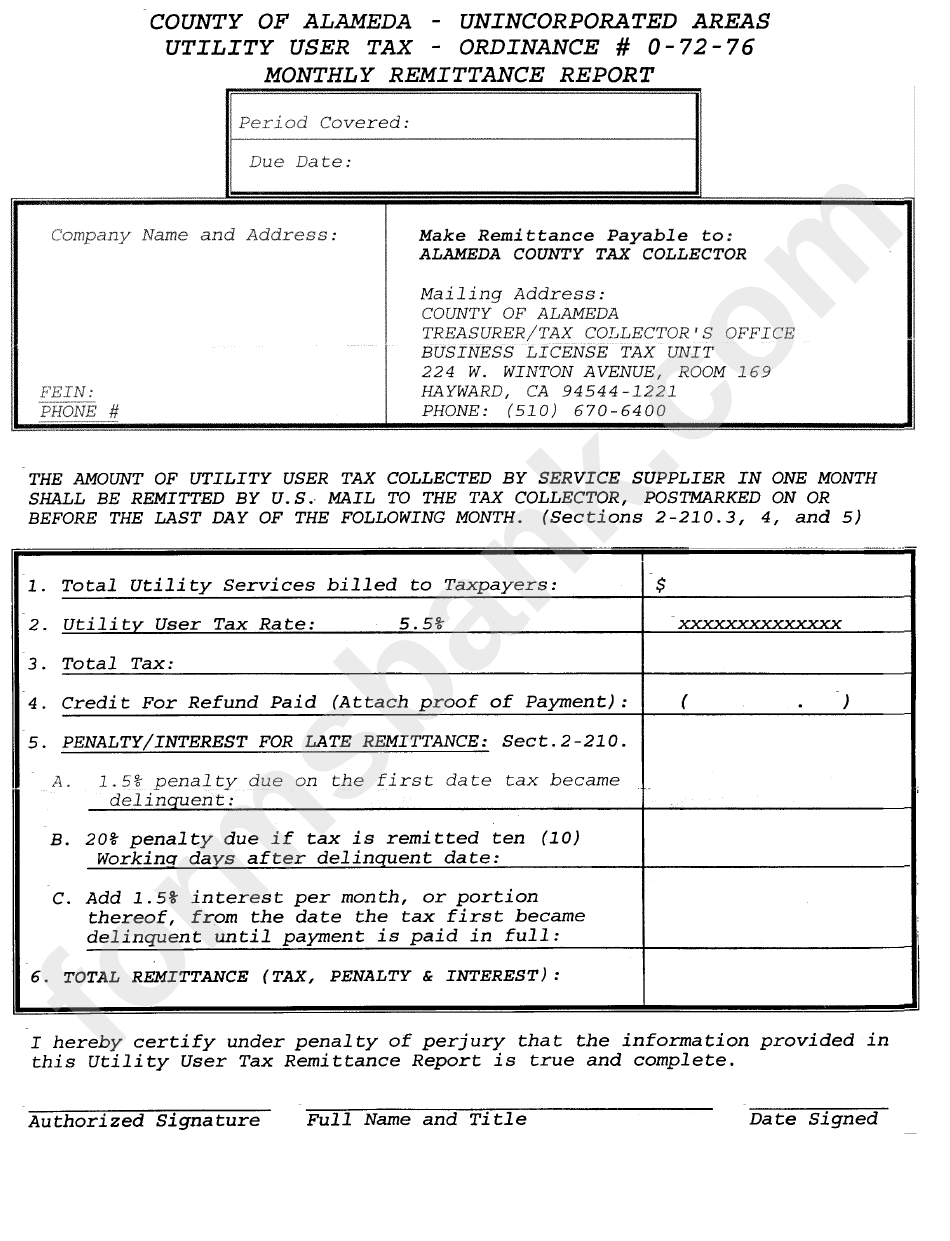

The base tax rate is typically 1% of the property’s assessed value, but voter-approved bonds and special assessments can add to this amount. As of the latest data, the average percentage levied against properties in Alameda County was 0.866%. However, this can vary depending on the location within the county.

Tax Rates for Alameda County

The tax rates in Alameda County can vary significantly depending on where your property is located. For example, homes in Piedmont may be valued at around seven figures, resulting in a $10,000 tax bill, while homes in San Leandro might be around $380,000, leading to a roughly $3,200 tax bill.

In addition to the base tax rate, there are also fixed charges and special assessments for city services and voter-approved projects. These funds are distributed among various sectors, including schools, parks, libraries, transit, and civic services. Here’s a breakdown of how every dollar collected by the local government is allocated:

- Schools: 41 cents

- Cities: 18 cents

- Redevelopment projects: 13 cents

- Special districts: 13 cents

- County: 15 cents

If you have any questions about the exact nature of extra charges on your tax bill, the number of the agency will be listed on your bill, and you can call them directly for clarification.

How to Pay Your Alameda County Property Taxes

Paying your Alameda County property taxes is straightforward, with multiple options available to suit your preferences. You can pay through the mail, in person, online, or via a mobile app. The Alameda County app, AC Property, is available for iPhone and Android users, though using the app incurs a 2.5% credit card convenience fee.

To pay by mail, make your check payable to the Treasurer-Tax Collector, Alameda County, and send it to:

Alameda County Treasurer-Tax Collector

1221 Oak Street, Room 131

Oakland, CA 94612

You can also visit the office in person, located just a few blocks away from Lake Merritt, to pay with cash, money order, or cashier’s check. If you prefer to pay by phone, the number is 510-272-6800.

Payment Deadlines and Penalties

The first installment of your property tax is due between November 1 and December 10. Any delinquent payments made after that will incur a 10% penalty. The second installment is due between February 1 and April 10, with a similar 10% penalty for late payments. If December 10 or April 10 falls on a weekend or holiday, you won’t be penalized as long as the payment is received by 5:00 PM on the following business day.

If you have a mortgage, your lender may handle your property tax payments. However, if you’ve paid off your home or your lender no longer does this, make sure you’ve received your tax bill and pay it on time.

How to Lower Your Tax Liability

There are several strategies you can use to lower your property tax liability in Alameda County. Here are some effective methods:

1. Apply for the Homeowners’ Exemption

If you own and occupy your home as your principal residence on January 1, you’re eligible for a $7,000 reduction in your property’s assessed value, translating to approximately $70 in annual tax savings. To claim this exemption, complete the BOE-266 form and submit it to the Alameda County Assessor’s Office. This is a one-time application, but ensure your residency status remains current.

2. Request a Decline-in-Value Reassessment (Proposition 8)

Under Proposition 8, if your property’s market value as of January 1 is less than its assessed value, you can request a temporary reduction in assessed value. To apply, provide the Assessor’s Office with evidence, such as sales data of comparable properties sold between January 1 and March 31. Approved reductions apply for one fiscal year and are reviewed annually.

3. File a Formal Assessment Appeal

If you disagree with your property’s assessed value, you can file a formal appeal with the Alameda County Assessment Appeals Board. The filing period for regular assessments is from July 2 to September 15. To initiate the process, complete the Assessment Appeal Application and submit it along with the $50 non-refundable fee. Be prepared to provide supporting documentation, such as recent appraisals or comparable sales data.

4. Understand Proposition 19 Benefits

Proposition 19 allows homeowners over 55, individuals with disabilities, and victims of natural disasters to transfer their property’s tax base to a new home of equal or lesser value anywhere in California. This can result in significant tax savings when downsizing or relocating.

5. Explore Additional Exemptions

Beyond the standard Homeowners’ Exemption, Alameda County offers other exemptions that can reduce your property tax liability:

- Veterans’ Exemption: Available to eligible veterans, this exemption can provide additional tax relief.

- Church and Welfare Exemption: Applicable to properties used exclusively for religious or charitable purposes.

For more information on these exemptions and to determine your eligibility, contact the Assessor’s Office at (510) 272-3770.

Comparing Alameda County to Other Cities

Alameda County is one of the most diverse counties in terms of property value, with a wide range of home prices and tax bills. While the average tax bill in Alameda County is slightly over $4,000, this varies greatly depending on the location within the county. For example, urban areas around Oakland may see lower home values in the $200,000 range, while areas like Piedmont can see home values around one million dollars or more.

Compared to the rest of California and the United States, Alameda County’s property tax rates are relatively high. The state average is $3,414, while the national average is $2,279. This disparity is partly due to the higher cost of living in the Bay Area, including a higher sales tax rate of 9.25% in Alameda County.

Agencies Involved in Alameda County Property Tax

Several agencies are involved in the administration of property taxes in Alameda County. These include:

- Alameda County Assessor: Responsible for assessing taxpayer property, adjusting annual assessments, applying tax exemptions, and finalizing reassessments.

- Auditor-Controller: Oversees the financial operations of the county, including the distribution of tax revenue.

- Alameda County Treasurer and Tax Collector: Handles the collection of property taxes and the distribution of tax bills.

Contact Information

- Alameda County Assessor’s Office:

- Address: 1221 Oak St., STE 145, Oakland, CA 94612

- Phone: (510) 272-3787

-

Hours: 8:30 a.m. to 5 p.m. on weekdays

-

Alameda County Treasurer Tax Collector:

- Address: 1221 Oak St., #131, Oakland, CA 94612

- Phone: (510) 272-6800

- Hours: 8:30 a.m. to 5 p.m. on weekdays

Important Dates for Alameda County Property Tax

Understanding the key dates associated with property taxes in Alameda County is essential for timely compliance. Here are the important dates to note:

- January 1: The application for property assessment starts at 12:01 am.

- February 15: The last date to apply for tax exemption.

- April 10: The last date to pay the second installment of property tax.

- July 1: Assessors deliver property assessment roll to the Auditor-Controller.

- July 2: The first date to file an appeal.

- Mid-July: The reassessment notice is sent to those concerned.

- September 15: The last date for filing an assessment appeal.

- December 10: The last date to file a late exemption claim.

- December 10: The first date for payment of the second installment.

How to Calculate Alameda Property Tax

The formula for calculating Alameda property tax is as follows:

(1% of assessed value + special assessments + voter-approved bonds) – Tax exemptions = your Alameda property tax bill

In Alameda, the median home price is about $1.275 million, which means the tax bill for such a property would be around $14,823. However, if you buy a house in Alameda County and want to check the property taxes, you can use 1.25% as the yardstick to estimate them.

Parcel Taxes and Exemptions

In addition to the base tax, there are parcel taxes that apply to each parcel of land. Unlike other taxes, parcel taxes are not based on the property’s worth; rather, they are a uniform tax on each parcel. In Alameda, the Unified School District charges $0.265 per square foot annually, starting in 2020 and expected to last until 2028.

Certain groups, such as low-income earners, the elderly, and the disabled, may qualify for parcel tax exemptions. If you’re among these groups, you won’t have to pay the parcel tax.

Conclusion

Navigating the complexities of Alameda property tax requires a thorough understanding of the assessment process, payment procedures, exemptions, and potential challenges. By leveraging the strategies outlined in this guide, you can effectively manage your property tax situation and potentially reduce your tax liability.

Whether you’re a homeowner looking to understand your obligations or an investor seeking to optimize your returns, this guide provides valuable insights into the Alameda property tax system. Stay informed, take advantage of available exemptions, and consider appealing your assessed value if necessary. With the right knowledge and resources, you can make informed decisions that benefit your financial well-being.

Stay updated with the latest news and developments in Alameda property tax to ensure you’re always in the know.

Meta Title: Understanding Alameda Property Tax: A Complete Guide

Meta Description: Learn how Alameda property tax works, how to calculate it, and strategies to lower your liability. Essential for homeowners and investors.

Author: John Doe

Title/Role: Real Estate Analyst

Credentials: John has over a decade of experience in real estate and property taxation, with a focus on the San Francisco Bay Area. He holds a degree in Economics and has contributed to numerous publications on housing and finance.

Profile Link: https://www.johndoe.com

Sources:

– Alameda County Assessor’s Office

– California Department of Tax and Fee Administration

– US Census Bureau

Internal Links:

– How to File a Property Tax Appeal in Alameda

– Understanding Proposition 13 in California

– Alameda County Homeowner Exemptions

Schema Markup:

{

"@context": "https://schema.org",

"@type": "Article",

"headline": "Understanding Alameda Property Tax: A Complete Guide for Homeowners",

"description": "Learn how Alameda property tax works, how to calculate it, and strategies to lower your liability. Essential for homeowners and investors.",

"author": {

"@type": "Person",

"name": "John Doe"

},

"datePublished": "2023-10-15",

"publisher": {

"@type": "Organization",

"name": "Real Estate Insights",

"logo": {

"@type": "ImageObject",

"url": "https://www.example.com/logo.png"

}

}

}

Featured Snippet Optimization:

“Alameda property tax is based on the assessed value of your property, with a 2% annual increase cap under Proposition 13. Homeowners can apply for exemptions and appeals to potentially reduce their tax liability.”

Call to Action:

Stay updated with the latest news and developments in Alameda property tax to ensure you’re always in the know.

URL Slug: /understanding-alameda-property-tax

Image Optimization:

–

–

–

–

–

More Stories

US Trending News: Adam Brody’s Kids: All About the Actor’s Family Life

US Trending News: Affiliate Secrets Review

US Trending News: Everything You Need to Know About the Air Show in Jacksonville Beach