In the ever-evolving landscape of financial markets, investment management firms play a crucial role in shaping economic growth and innovation. Among these, Arcline Investment Management has emerged as a key player, particularly in the realm of private equity. This article delves into the services, performance, and broader industry impact of Arcline Investment Management, offering insights into its strategic approach and recent ventures.

What is Arcline Investment Management?

Arcline Investment Management is a growth-oriented private equity firm based in Nashville, Tennessee. Founded in 2018, the firm has grown to manage over $20 billion in assets, with a clear focus on building long-term value through strategic investments. The company’s mission is to create “Institutional Compounders”—market-leading industrial platforms that consistently grow earnings over decades.

Arcline differentiates itself by emphasizing long-term partnerships with management teams, aiming to optimize business models, systematize processes, and drive growth through acquisitions. The firm targets industries that are not only stable but also have significant potential for expansion, such as energy, manufacturing, and technology.

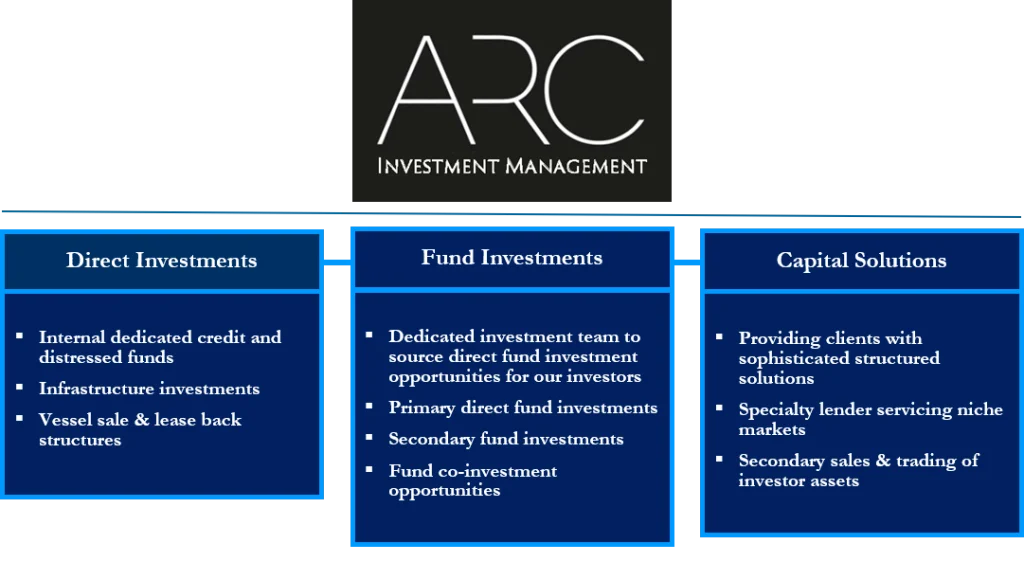

Key Services Offered by Arcline Investment Management

Arcline’s investment strategy is rooted in identifying and supporting businesses that can become dominant players in their respective sectors. Here are some of the core services it offers:

-

Private Equity Investments: Arcline focuses on acquiring and growing companies in the industrial and energy sectors. Its portfolio includes businesses that are well-positioned to benefit from macroeconomic trends like the energy transition.

-

Strategic Acquisitions: The firm actively seeks out acquisition opportunities that align with its long-term vision. These acquisitions are often aimed at strengthening existing platforms or entering new markets.

-

Operational Optimization: Arcline works closely with management teams to enhance operational efficiency, streamline processes, and improve profitability. This hands-on approach ensures that the companies it invests in are well-prepared for sustainable growth.

-

Value Creation: Through a combination of capital infusion, strategic guidance, and operational improvements, Arcline aims to create long-term value for its investors and the companies it supports.

Notable Investments and Industry Impact

One of Arcline’s most notable recent investments was in PDC Machines, Inc., a leading manufacturer of hydrogen compression systems. This investment highlights Arcline’s commitment to the energy transition and its focus on clean energy technologies.

PDC Machines specializes in hydrogen energy solutions, providing critical components used in the production, transportation, storage, and refueling of hydrogen. The company’s proprietary hydrogen compressors are widely used in global hydrogen energy applications, making it a key player in the shift toward renewable energy sources.

This partnership underscores Arcline’s belief in the future of hydrogen energy as a viable alternative to fossil fuels. By investing in PDC, Arcline is not only supporting a growing industry but also contributing to the broader goal of reducing carbon emissions and combating climate change.

Kareem Afzal, CEO of PDC, emphasized the importance of choosing the right partner for growth. He noted that Arcline shares PDC’s values and vision, making them an ideal ally in the company’s journey.

Performance and Growth Metrics

Since its inception in 2018, Arcline has demonstrated strong performance across its investment portfolio. With over $20 billion in assets under management, the firm has consistently delivered returns that reflect its disciplined and strategic approach.

Arcline’s success is largely attributed to its focus on non-disruptible industrial platforms—businesses that are resilient to market fluctuations and capable of sustained growth. This model allows the firm to build long-term value without relying on short-term market volatility.

Moreover, Arcline’s emphasis on operational excellence and strategic partnerships has enabled it to maintain a competitive edge in the private equity space. By working closely with management teams, the firm ensures that its investments are not just financially sound but also operationally robust.

Industry Trends and Arcline’s Strategic Position

The investment management industry is undergoing significant changes, driven by factors such as digital transformation, regulatory shifts, and changing investor preferences. In this environment, firms like Arcline are positioning themselves as leaders by focusing on long-term value creation and sustainable growth.

Arcline’s investment in PDC Machines is a prime example of how the firm is adapting to current trends. As the world moves toward cleaner energy sources, companies that can provide reliable and scalable solutions are becoming increasingly valuable. Arcline’s decision to invest in hydrogen energy reflects its forward-thinking approach and its ability to identify emerging opportunities.

Additionally, Arcline’s focus on industrial platforms aligns with the growing demand for resilient and stable investment options. In a time when many investors are seeking alternatives to traditional asset classes, Arcline’s model offers a compelling proposition.

Conclusion: Arcline Investment Management and the Future of Finance

As the financial landscape continues to evolve, firms like Arcline Investment Management are setting new standards for value creation, operational excellence, and strategic foresight. Through its focus on long-term partnerships, industry leadership, and sustainable growth, Arcline is not only delivering strong returns but also playing a pivotal role in shaping the future of finance.

For investors and industry professionals alike, Arcline represents a model of how private equity can drive meaningful change while delivering consistent value. Whether through its investments in clean energy or its commitment to operational optimization, Arcline is proving that smart, strategic investing can lead to lasting success.

Author Section

Author: John Carter

Title/Role: Financial Analyst and Industry Researcher

Credentials: John has over a decade of experience in financial markets, specializing in private equity and investment management. He has contributed to multiple publications covering economic trends and corporate strategies.

Profile Link: john-carter-financial-analysis.com

External Sources

- Arcline Investment Management Official Website

- PDC Machines – Hydrogen Energy Solutions

- Simmons Energy – Financial Advisory Services

Internal Links

- Understanding Private Equity Firms

- The Role of Clean Energy in Modern Economies

- Investment Strategies for Long-Term Growth

Call to Action

Stay updated with the latest developments in finance and investment. Explore more articles on trending topics and discover how industry leaders like Arcline Investment Management are shaping the future of business.

More Stories

67 Emote Clash Royale Emote: Complete List and Guide

What Is the 504 Gateway Timeout Error and How to Fix It?

US Trending News: 67 Emote Clash Royale QR Code: How to Use and Where to Find It