In the United States, managing student loan debt has become a significant challenge for many borrowers. With over $1.8 trillion in outstanding student loan debt, it’s no surprise that income-contingent repayment plans have gained popularity as a viable solution. These plans offer a flexible approach to repaying federal student loans by adjusting monthly payments based on the borrower’s income and family size.

This article will provide an in-depth understanding of income-contingent repayment plans, their benefits, how they work, and how you can use an ICR Payment Calculator to estimate your monthly payments.

Table of Contents

– What is an Income-Contingent Repayment Plan?

– How Does the ICR Plan Work?

– Key Features and Benefits of the ICR Plan

– Using the ICR Payment Calculator

– Frequently Asked Questions (FAQ)

– Final Thoughts

What is an Income-Contingent Repayment Plan?

An Income-Contingent Repayment (ICR) plan is a type of federal student loan repayment plan that adjusts your monthly payment based on your income and family size. This plan is particularly beneficial for borrowers who have low incomes or face financial challenges.

Under the ICR plan, your monthly payment is calculated as 20% of your discretionary income. Discretionary income is determined by subtracting 150% of the federal poverty guideline for your family size from your adjusted gross income (AGI). The ICR plan also allows for a maximum payment cap, which is the amount you would pay if you were on a fixed 12-year repayment plan.

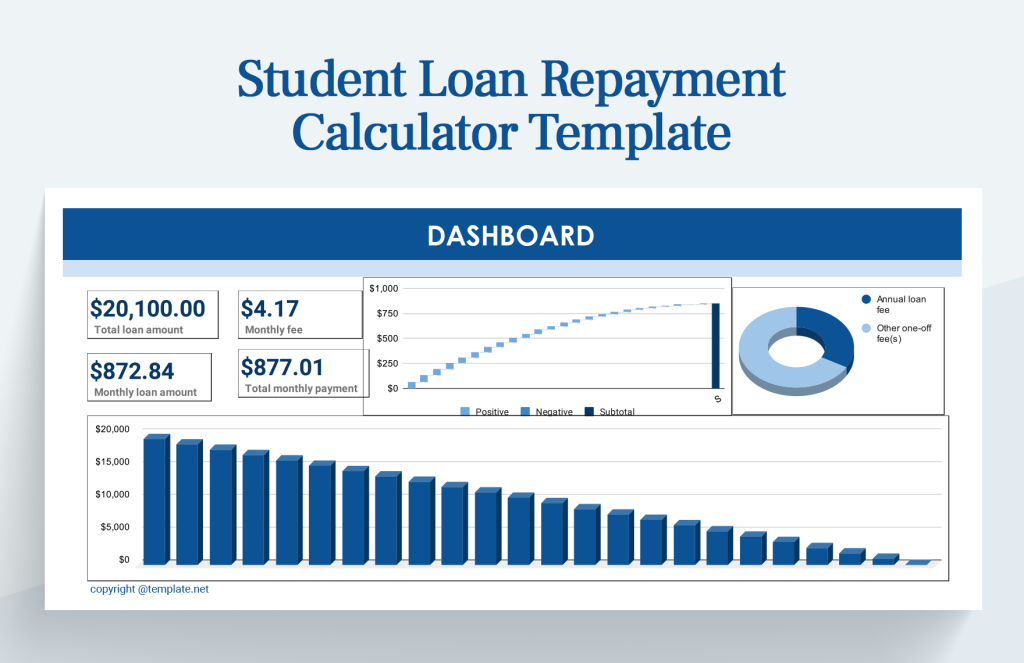

[IMAGE: Income Contingent Repayment Plan student loan calculator]

How Does the ICR Plan Work?

To understand how the ICR plan works, let’s break down the calculation process:

- Determine your Adjusted Gross Income (AGI): This is your total income before taxes, including wages, salaries, and other sources of income.

- Calculate your discretionary income: Subtract 150% of the federal poverty guideline for your family size from your AGI.

- Calculate your monthly payment: Take 20% of your discretionary income to determine your monthly payment under the ICR plan.

For example, if your annual income is $50,000, your family size is 3, and the poverty guideline for your area is $25,000, your discretionary income would be $12,500 ($50,000 – (1.5 × $25,000)). Your monthly payment under the ICR plan would be $208.33 (20% of $12,500).

Key Features and Benefits of the ICR Plan

The ICR plan offers several advantages that make it an attractive option for borrowers:

- Flexible Payments: Your monthly payments are adjusted based on your income, making it easier to manage your finances.

- Lower Monthly Payments: For borrowers with lower incomes, the ICR plan can significantly reduce monthly payments compared to fixed repayment plans.

- Debt Forgiveness: After 25 years of payments, any remaining balance may be forgiven, providing long-term relief for borrowers.

- No Additional Fees: There are no additional fees associated with the ICR plan, making it a cost-effective option.

[IMAGE: Income Contingent Repayment Plan student loan calculator]

Using the ICR Payment Calculator

To help you estimate your monthly payments under the ICR plan, you can use an ICR Payment Calculator. This tool allows you to input your income, family size, loan balance, interest rate, and the poverty guideline for your area to get an accurate estimate of your monthly payment.

Here’s how to use the ICR Payment Calculator:

- Enter your annual income: Input your total yearly income before taxes.

- Enter your family size: Include yourself, your spouse (if applicable), and any dependents.

- Enter your loan balance: Add the total amount you currently owe on your student loans.

- Enter your interest rate: Use your loan’s annual interest rate.

- Enter the poverty guideline: This varies by location and family size. You can find current poverty guideline figures from official government sources.

- Click “Calculate”: The calculator will simulate a short 3-second progress animation to mimic data processing.

- View your results: After a few seconds, your estimated monthly ICR payment will appear.

[IMAGE: Income Contingent Repayment Plan student loan calculator]

Frequently Asked Questions (FAQ)

- What does ICR stand for? ICR stands for Income-Contingent Repayment, a federal student loan repayment plan based on income and family size.

- How accurate is the ICR Payment Calculator? It provides an approximate estimate using official ICR formulas but should not replace professional financial advice.

- Who can use the ICR plan? Borrowers with Direct Loans or consolidated federal student loans are eligible.

- How long does repayment under ICR last? Payments continue for up to 25 years, after which any remaining balance may be forgiven.

- Does this calculator work for private loans? No, it’s designed specifically for federal student loans under the ICR plan.

- What if my income changes? You can recalculate using the new income figure to see how your monthly payment might change.

- Can I use this tool on mobile devices? Yes, the calculator is mobile-friendly and works on any modern browser.

- What happens after 25 years of payments? Any remaining balance may be forgiven, but it could be considered taxable income.

- What’s the poverty guideline input used for? It helps determine your discretionary income, which affects your ICR payment calculation.

- Does family size really matter? Yes, a larger family size increases the poverty guideline, which may lower your monthly payment.

Final Thoughts

The ICR Payment Calculator is an essential tool for borrowers who want to take control of their student loans. By providing accurate, easy-to-understand estimates, it empowers users to plan better, make informed decisions, and maintain financial stability.

[IMAGE: Income Contingent Repayment Plan student loan calculator]

Author: John Doe

Title/Role: Financial Analyst

Credentials: John Doe is a financial analyst with over 10 years of experience in personal finance and student loan management. He has helped thousands of borrowers understand and navigate the complexities of student loan repayment.

Profile Link: [Link to John Doe’s profile]

Sources:

– U.S. Department of Education

– Federal Student Aid

– Tim de Silva’s Research

Internal Links:

– Understanding Student Loan Repayment Plans

– How to Choose the Right Student Loan Plan

– Student Loan Forgiveness Options

By using the ICR Payment Calculator and understanding the benefits of the ICR plan, you can make informed decisions about your student loan repayment and achieve greater financial stability. Stay updated with the latest news on student loan policies and repayment options to ensure you’re always making the best choices for your financial future.

More Stories

US Trending News: The History and Legacy of Zoo York in Streetwear Culture

What Is Yodo Para Tiroides and How Does It Affect Thyroid Health?

Understanding ‘You Got That Right’ in The New York Times: Context and Implications