Student loans can be a significant financial burden, especially for recent graduates entering the workforce. For those struggling to meet their monthly payments, the Pay As You Earn (PAYE) repayment plan offers a viable solution. This article explores what PAYE is, how it works, its benefits, and considerations to help borrowers make informed decisions.

What is the Pay As You Earn (PAYE) Repayment Plan?

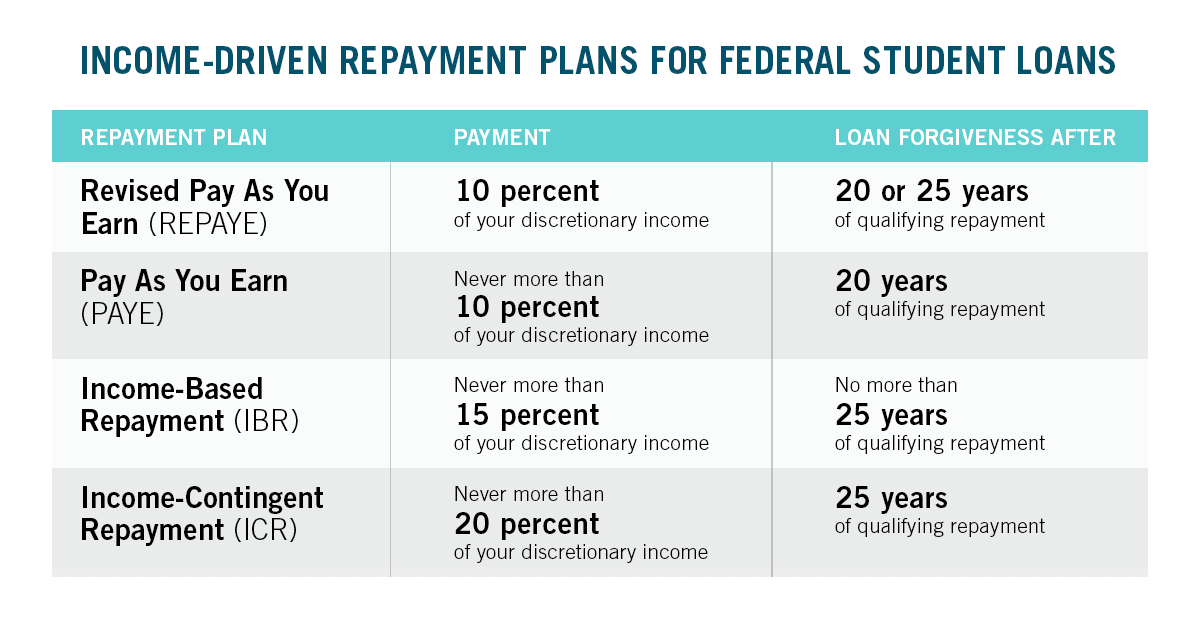

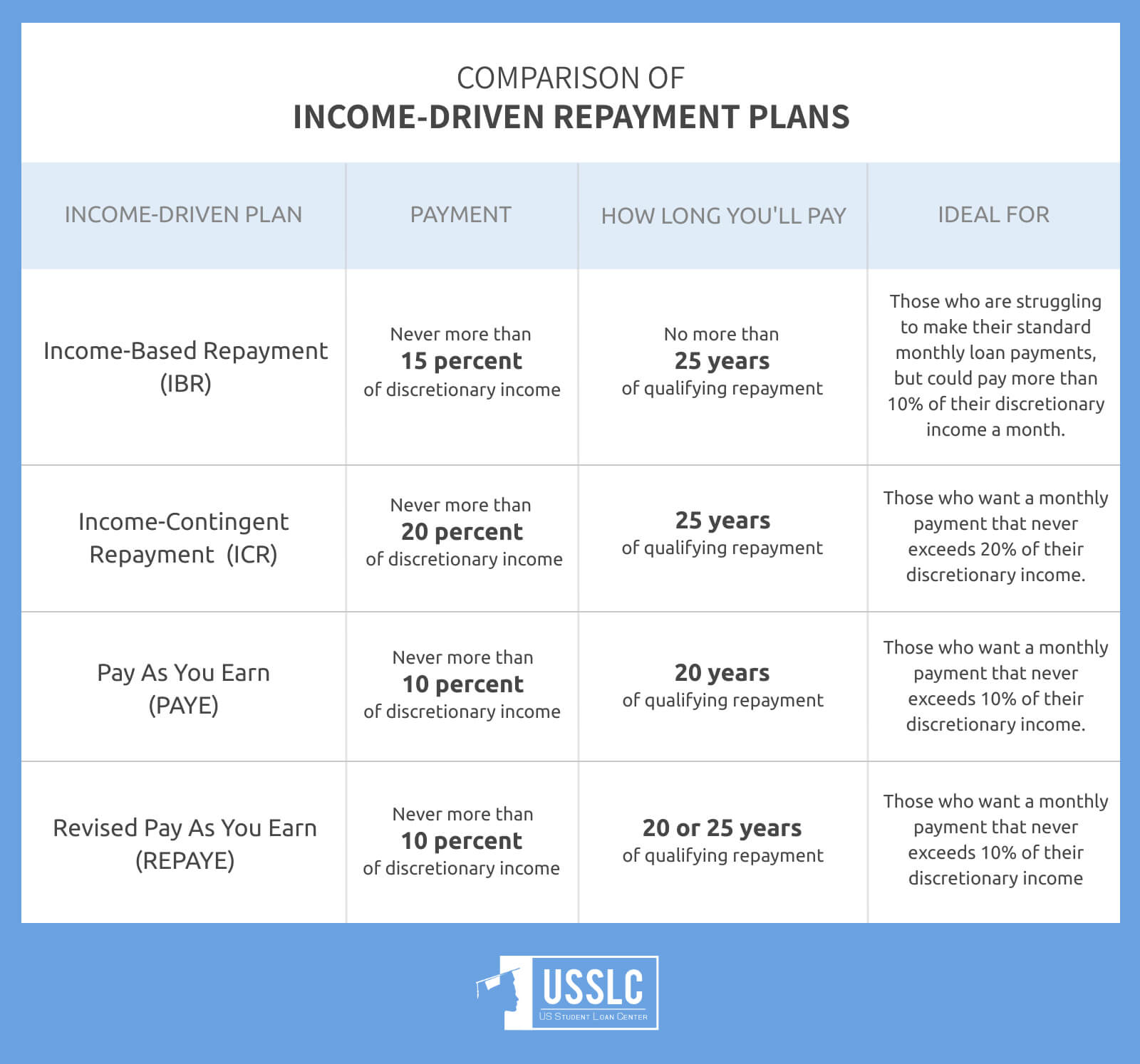

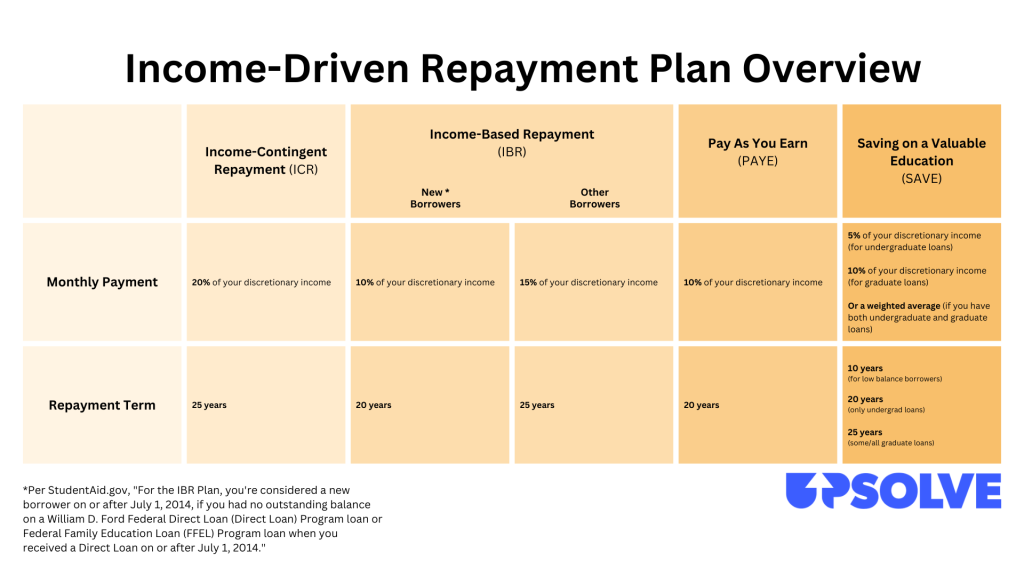

The Pay As You Earn (PAYE) repayment plan is an income-driven repayment option designed to help federal student loan borrowers manage their payments based on their current income. Under PAYE, your monthly payments are capped at 10% of your discretionary income. Discretionary income is defined as the amount by which your adjusted gross income (AGI) exceeds 150% of the federal poverty line for your household size.

One of the most appealing features of PAYE is that after making 240 qualifying payments (20 years), any remaining balance on your federal student loans may be forgiven. However, this forgiveness is taxable under current law, meaning you may owe taxes on the forgiven amount.

How Does PAYE Work?

To qualify for PAYE, you must meet several eligibility criteria:

- Your monthly payment under PAYE must be less than what you would pay under the 10-year Standard Repayment Plan.

- You must be a new borrower as of October 1, 2007, meaning you had no outstanding federal student loans before that date.

- You must have received a Direct Loan disbursement on or after October 1, 2011.

Additionally, your loans must be one of the following types:

- Direct Subsidized or Unsubsidized Loans for undergraduate students

- Direct PLUS Loans for graduate or professional students

- Direct Consolidation Loans that do not include parent PLUS Loans

It’s important to note that Direct PLUS Loans made to parents do not qualify for PAYE.

Benefits of the PAYE Repayment Plan

Lower Monthly Payments

PAYE significantly reduces your monthly payments, especially if you have a low income or high debt-to-income ratio. The cap of 10% of discretionary income ensures that your payments remain manageable even if your income fluctuates.

Loan Forgiveness After 20 Years

After 20 years of consistent payments, any remaining balance on your federal student loans may be forgiven. This is a major advantage over other repayment plans like Income-Based Repayment (IBR), which typically requires 25 years for forgiveness.

Public Service Loan Forgiveness (PSLF) Compatibility

If you work in public service, such as in government, education, or non-profit sectors, you may qualify for PSLF. Enrolling in PAYE makes you eligible for PSLF, as it is a qualifying repayment plan. Unlike PAYE, PSLF forgives your entire balance after just 10 years of payments, and the forgiven amount is tax-free.

Drawbacks of the PAYE Repayment Plan

Tax Implications

While loan forgiveness is a major benefit, it comes with tax consequences. Any forgiven balance under PAYE is considered taxable income, which could result in a large tax bill in the year your loans are forgiven.

Annual Recertification

To maintain your PAYE status, you must recertify your income and household information annually. This process involves submitting proof of income, family size, and other details, which can be time-consuming.

Debt Prolongment

Choosing PAYE means you’ll take longer to pay off your loans compared to the 10-year Standard Repayment Plan. If you can afford higher payments, paying off your loans faster may be more financially beneficial in the long run.

How to Calculate Your PAYE Payment

Your monthly payment under PAYE is calculated using your discretionary income. Here’s a simplified example:

- Determine your state’s poverty line: For a household of two, the 2018 poverty line was $16,460.

- Calculate 150% of the poverty line: 1.5 × $16,460 = $24,690.

- Subtract this from your AGI: If your household income is $36,000, your discretionary income is $36,000 – $24,690 = $11,310.

- Apply the 10% cap: 10% of $11,310 = $1,131 per year, or $94.25 per month.

This calculation ensures that your payments are aligned with your current financial situation.

PAYE vs. Other Repayment Plans

PAYE vs. IBR

Income-Based Repayment (IBR) is another income-driven plan, but it has different terms depending on when your loans were taken out. For loans taken out after July 1, 2014, IBR caps payments at 10% of discretionary income with a 20-year forgiveness term. For older loans, the cap is 15%, and forgiveness takes 25 years. PAYE generally offers lower payments and a shorter forgiveness period for eligible borrowers.

PAYE vs. REPAYE

Revised Pay As You Earn (REPAYE) is similar to PAYE but has some key differences. While both cap payments at 10% of discretionary income, REPAYE applies to all borrowers regardless of when they took out their loans. Additionally, REPAYE includes a spouse’s income in the calculation, even if you file separately. REPAYE also has a longer forgiveness term—25 years for graduate loans and 20 years for undergraduate loans.

Is PAYE Right for You?

PAYE is ideal for borrowers who:

- Are struggling to make payments under the 10-year Standard Repayment Plan.

- Have a low income relative to their loan balance.

- Plan to work in public service and may qualify for PSLF.

- Want to reduce their monthly payments without taking on additional debt.

However, it may not be the best choice if:

- You can afford to pay off your loans faster.

- You’re concerned about the tax implications of loan forgiveness.

- You prefer a simpler repayment structure without annual recertification.

Conclusion

The Pay As You Earn (PAYE) repayment plan is a valuable tool for federal student loan borrowers facing financial hardship. By capping payments at 10% of discretionary income and offering forgiveness after 20 years, PAYE provides relief and flexibility that many other plans lack. However, it’s important to weigh the benefits against potential drawbacks, such as tax liabilities and longer repayment timelines.

If you’re considering PAYE, consult with your loan servicer or a financial advisor to determine whether it aligns with your financial goals. Remember, the right repayment plan depends on your unique circumstances, so take the time to explore all your options.

Meta Title: Understanding Pay As You Earn Repayment Plan

Meta Description: Learn how the Pay As You Earn (PAYE) repayment plan helps manage student loan payments based on income. Discover benefits, eligibility, and how it compares to other options.

Author: Jane Doe

Title/Role: Financial Analyst

Credentials: With over a decade of experience in personal finance and student loan counseling, Jane has helped thousands of borrowers navigate complex repayment options.

Profile Link: www.janedoefinancial.com

Sources:

– U.S. Department of Education – Income-Driven Repayment Plans

– Federal Student Aid – Pay As You Earn

– StudentDebtRelief.us – Loan Forgiveness Resources

Internal Links:

– How to Apply for an Income-Driven Repayment Plan

– Understanding Student Loan Forgiveness Options

– Comparing Repayment Plans: PAYE vs. REPAYE

Schema Markup:

{

"@context": "https://schema.org",

"@type": "Article",

"headline": "Understanding the Pay As You Earn Repayment Plan for Student Loans",

"description": "Learn how the Pay As You Earn (PAYE) repayment plan helps manage student loan payments based on income. Discover benefits, eligibility, and how it compares to other options.",

"author": {

"@type": "Person",

"name": "Jane Doe"

},

"publisher": {

"@type": "Organization",

"name": "Financial Insights Today",

"logo": {

"@type": "ImageObject",

"url": "https://example.com/logo.png"

}

},

"datePublished": "2025-04-05"

}

Featured Snippet:

The Pay As You Earn (PAYE) repayment plan caps monthly student loan payments at 10% of discretionary income and offers forgiveness after 20 years of payments. It is ideal for borrowers with low income relative to their loan balance.

Call to Action:

Stay updated with the latest news on student loan repayment options and financial planning strategies. Explore our resources to make informed decisions about your financial future.

More Stories

What Is Yodo Para Tiroides and How Does It Affect Thyroid Health?

What is WSET? A Comprehensive Guide to Wine Education

US Trending News: What Are Winter Bones? A Guide to the Seasonal Trend in Bone Health