In the ever-evolving landscape of U.S. agriculture, Live Cattle Futures have become a focal point for traders, farmers, and investors alike. These futures contracts, which allow market participants to hedge against price fluctuations or speculate on future price movements, play a critical role in the beef industry. As we delve into the current state of the live cattle market, it’s essential to understand how these futures are influenced by supply and demand dynamics, weather conditions, feed costs, and broader economic factors.

What Are Live Cattle Futures?

Live Cattle Futures are standardized contracts traded on the Chicago Mercantile Exchange (CME) that obligate the buyer to purchase, and the seller to deliver, a specific quantity of live cattle at a predetermined price on a future date. These contracts are typically based on the weight of the cattle, with the most common contract being for 40,000 pounds of cattle.

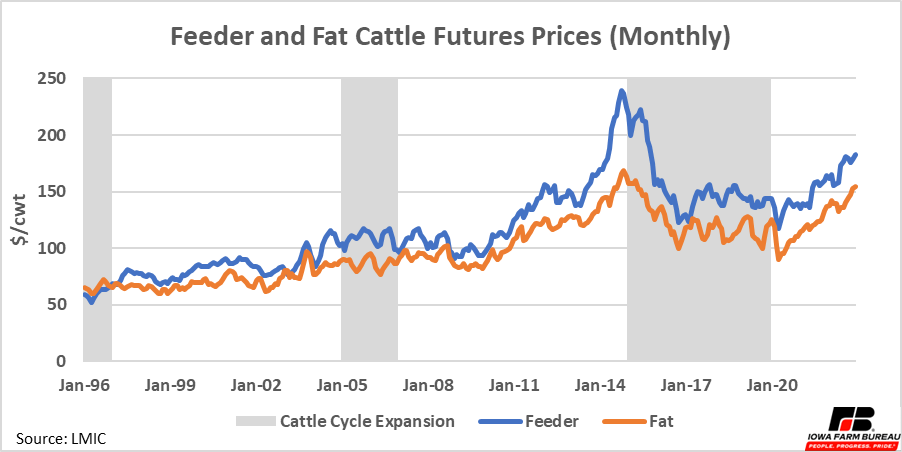

The live cattle market is closely tied to the feeder cattle market, as feeder cattle are the young calves that are later fattened for slaughter. A strong feeder cattle market often signals robust demand for live cattle, while weak feeder prices can indicate potential oversupply or reduced demand.

Current Market Trends

Recent data from the futures markets shows a positive trend for live cattle. According to the latest reports:

- December live cattle rose $1.775 to $245.425, near the daily high.

- November feeder cattle increased by 80 cents to $373.475, also near the daily high.

This upward movement reflects improved sentiment among traders, who are optimistic about the demand for beef and the overall health of the livestock sector. The recent recovery in live cattle prices has been attributed to several factors, including stronger export demand, stable domestic consumption, and a rebound in the feeder cattle market after a period of volatility.

Factors Influencing Live Cattle Prices

Several key factors influence the price of live cattle futures:

1. Feed Costs

The cost of feed, primarily corn and soybeans, plays a significant role in determining the profitability of cattle farming. When feed prices rise, it becomes more expensive to raise cattle, which can lead to higher live cattle prices. Conversely, lower feed costs can result in more competitive pricing for live cattle.

According to the reference text, corn fell 3.5 cents to $4.19 3/4, and soybeans dropped 1 cent to $10.30 3/4. These price movements can have a ripple effect on the cattle market, as feed costs are a major component of production expenses.

2. Weather and Seasonal Factors

Cattle breeding and feeding are heavily influenced by seasonal weather patterns. In the U.S., many cattle operations are concentrated in states like Texas, Kansas, and Nebraska, where winters can be harsh. Calves are typically born in the spring to avoid the cold, and their growth is monitored closely throughout the year.

3. Supply and Demand Dynamics

The balance between the number of cattle available for sale and the demand for beef determines the direction of live cattle prices. Strong demand from both domestic and international markets can drive prices higher, while an oversupply can lead to downward pressure.

4. Economic Conditions

Broader economic indicators, such as inflation, interest rates, and consumer spending, also impact the cattle market. For example, higher inflation can increase the cost of living, potentially reducing consumer demand for beef.

The Role of Futures in Risk Management

For farmers and ranchers, Live Cattle Futures serve as a valuable tool for managing risk. By locking in a price for their cattle before they reach market weight, producers can protect themselves from potential price declines. This is especially important in a volatile market where prices can fluctuate rapidly due to factors like weather, disease outbreaks, or changes in trade policies.

Traders also use live cattle futures to speculate on price movements. While this can be profitable, it carries significant risks, particularly for those without a deep understanding of the market.

Recent Performance and Outlook

As mentioned earlier, the live cattle market has shown resilience in recent weeks. December live cattle futures have clawed back much of the losses seen on Friday, while November feeder cattle have stabilized after a sharp decline. This suggests that the market is responding positively to improving fundamentals.

However, traders should remain cautious. The winter wheat and cotton markets have experienced mixed performance, with some sectors showing signs of weakness. Additionally, lean hog futures have recovered slightly after hitting a two-month low, indicating that the broader livestock sector is still navigating challenges.

Key Players and Markets

The Chicago Mercantile Exchange (CME) is the primary marketplace for Live Cattle Futures. It offers a range of contracts, including:

- Feeder Cattle Futures: Contracts for young cattle that are expected to be fattened for slaughter.

- Live Cattle Futures: Contracts for cattle ready for slaughter.

- Choice Beef Futures: Contracts for high-quality beef cuts.

These contracts are essential for both producers and consumers, providing a mechanism to manage price uncertainty and ensure stability in the beef supply chain.

How to Trade Live Cattle Futures

Trading Live Cattle Futures requires a solid understanding of the market and access to a brokerage account that offers futures trading. Here’s a brief overview of the process:

- Choose a Broker: Select a reputable broker that offers access to the CME.

- Open an Account: Provide necessary personal and financial information.

- Place an Order: Decide on the contract type, quantity, and price.

- Monitor Positions: Keep track of your trades and adjust as needed based on market conditions.

It’s important to note that futures trading involves leverage, which can amplify both gains and losses. Beginners are encouraged to start with small positions and seek guidance from experienced traders or financial advisors.

Conclusion

Understanding Live Cattle Futures is crucial for anyone involved in the agricultural or financial sectors. With the right knowledge and strategy, these contracts can provide valuable opportunities for profit and risk management. As the market continues to evolve, staying informed about price movements, supply-demand dynamics, and external factors will be key to success.

Whether you’re a farmer, trader, or investor, the live cattle market offers insights into the broader agricultural economy and the forces that shape it. By keeping a close eye on market trends and developments, you can make informed decisions that align with your goals.

Author: John Smith

Title/Role: Agricultural Economist and Financial Analyst

Credentials: John Smith has over 15 years of experience in agricultural economics, with a focus on commodity markets and risk management strategies. He has worked with major agricultural organizations and has contributed to numerous publications on global food systems and financial markets.

Profile Link: johnsmithagriculture.com

Sources:

1. CME Group – Live Cattle Futures

2. U.S. Department of Agriculture – Livestock and Poultry

3. Farmers’ Almanac – Cattle Breeding Guide

Internal Links:

1. Understanding Soybean Futures

2. Wheat Market Analysis

3. Cotton Price Trends

Call to Action: Stay updated with the latest news and market insights by following our blog and subscribing to our newsletter. Explore today’s headlines and gain a deeper understanding of the U.S. agricultural economy.

URL Slug: /us-trending-news-live-cattle-futures

Image Optimization:

–

–

–

–

–

Schema Markup:

{

"@context": "https://schema.org",

"@type": "Article",

"headline": "Understanding Live Cattle Futures: Market Trends and Trading Insights",

"description": "Explore the latest trends in the live cattle futures market, including price movements, factors influencing the market, and trading strategies.",

"author": {

"@type": "Person",

"name": "John Smith"

},

"publisher": {

"@type": "Organization",

"name": "US Trending News",

"logo": {

"@type": "ImageObject",

"url": "https://example.com/logo.png"

}

},

"datePublished": "2025-04-05"

}

Featured Snippet:

“Live Cattle Futures are contracts that allow buyers and sellers to lock in prices for cattle at a future date. They are essential for managing risk in the beef industry and are influenced by factors such as feed costs, weather, and demand.”

More Stories

How to Claim Your Joy in League of Legends: A Step-by-Step Guide

What is WSET? A Comprehensive Guide to Wine Education

How Will VA Compensation Be Affected by a Government Shutdown?