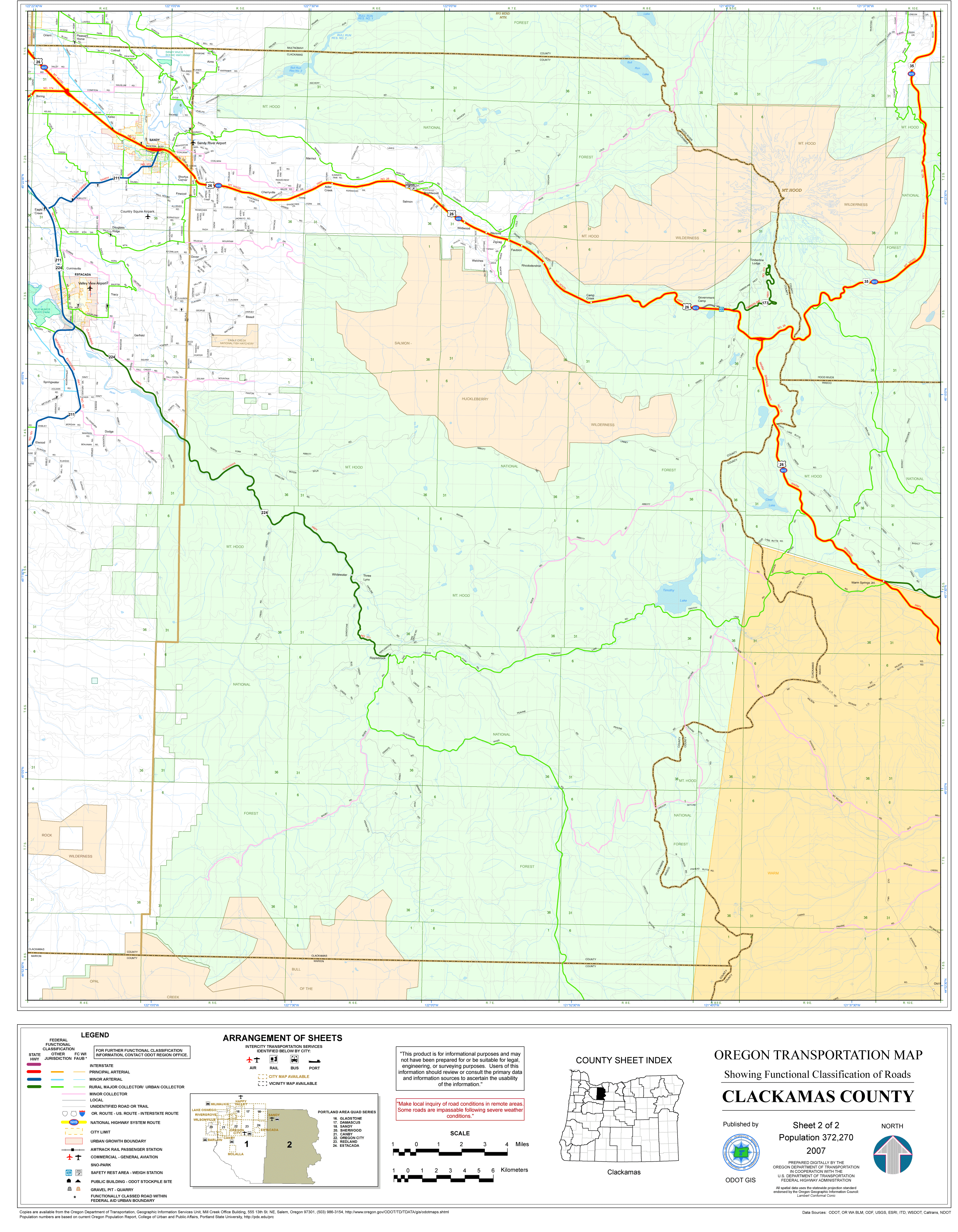

Clackamas County, located in the state of Oregon, is known for its high property taxes. As a homeowner in this area, it’s essential to understand how property taxes work and what factors contribute to the rates you pay. This guide provides a comprehensive overview of Clackamas County property tax, including the average rates, how they compare to other counties, and tips for managing your tax obligations.

What Is Clackamas County Property Tax?

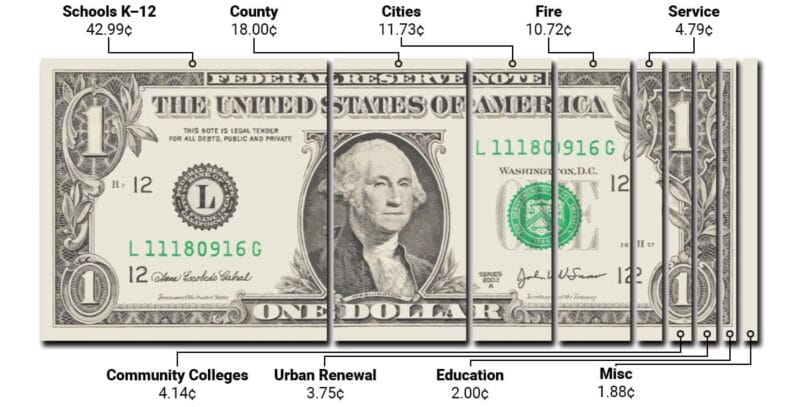

Property tax is a levy imposed on real estate by local governments. In Clackamas County, this tax is used to fund public services such as schools, roads, emergency services, and parks. The amount you pay depends on the assessed value of your property and the tax rate set by the county.

The median property tax in Clackamas County is $2,814 per year, based on a median home value of $331,100 and an effective tax rate of 0.85%. This makes Clackamas one of the top 25% of counties in the United States in terms of property tax collections.

How Does Clackamas County Compare?

Clackamas County has a higher property tax rate than many other counties in Oregon. With a 0.91% tax rate, it ranks 9th out of 36 counties in the state. This means that the tax rate is higher than 27 other counties, making it one of the more expensive areas for property taxes in Oregon.

For comparison, the state-wide median property tax rate is 0.86%. This slight difference can add up significantly over time, especially for homeowners with higher-valued properties.

Factors Influencing Property Taxes in Clackamas County

Several factors contribute to the property tax rates in Clackamas County:

1. Property Value

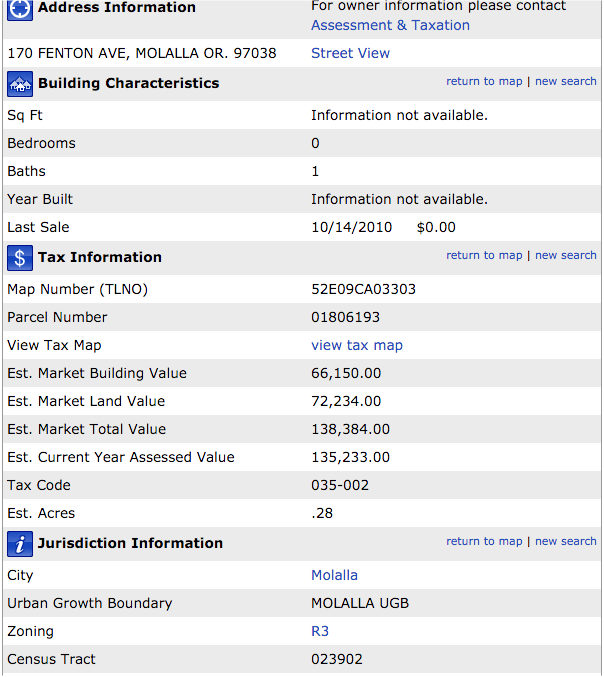

The assessed value of a property is the primary determinant of property tax. In Clackamas, the median home value is $331,100, which is higher than the statewide median of $257,400. Higher property values typically result in higher tax bills.

2. Tax Rate

The tax rate in Clackamas County is 0.91%, which is slightly above the state average. This rate is applied to the assessed value of the property to determine the annual tax payment.

3. Local Government Funding Needs

Local governments in Clackamas County rely on property taxes to fund essential services. As the population grows and infrastructure needs increase, these funding requirements can lead to adjustments in tax rates.

Property Tax Rates by ZIP Code

Property tax rates can vary significantly within Clackamas County depending on the ZIP code. Below are some examples of tax rates and corresponding property values for different areas:

| ZIP Code | Tax Rate | Property Value | Annual Tax |

|---|---|---|---|

| 97002 | 0.66% | $432,500 | $2,847 |

| 97004 | 0.60% | $639,300 | $3,853 |

| 97009 | 0.78% | $580,800 | $4,505 |

| 97011 | 0.77% | $548,900 | $4,244 |

| 97013 | 0.90% | $475,100 | $4,291 |

| 97015 | 1.03% | $462,800 | $4,789 |

| 97017 | 0.50% | $493,600 | $2,488 |

| 97019 | 0.56% | $618,100 | $3,445 |

| 97022 | 0.53% | $584,100 | $3,114 |

| 97023 | 0.77% | $463,900 | $3,582 |

These variations highlight the importance of understanding your specific ZIP code’s tax rate when planning your budget.

How to Calculate Your Property Tax

To calculate your property tax, you can use the following formula:

Annual Property Tax = Assessed Value × Tax Rate

For example, if your property is assessed at $500,000 and the tax rate is 0.91%, your annual tax would be:

$500,000 × 0.0091 = $4,550

This calculation helps you estimate your tax bill and plan accordingly.

Understanding Property Tax Assessments

Property tax assessments are conducted by local government agencies to determine the value of a property for tax purposes. In Clackamas County, assessments are typically done every few years, and the results are used to establish tax rates.

Homeowners have the right to challenge their assessment if they believe it is inaccurate. To do so, you can contact the Clackamas County Assessor’s Office or file an appeal through the appropriate channels.

Property Tax Exemptions and Deductions

There are several exemptions and deductions available to reduce property tax liability in Clackamas County. These include:

1. Senior Citizen Exemption

Homeowners aged 65 or older may qualify for a reduction in property taxes based on their income and other factors.

2. Veteran Exemption

Disabled veterans or surviving spouses of veterans may be eligible for a portion of their property taxes to be exempted. For 2025, the exemption for a disabled veteran or surviving spouse is $26,303 of assessed value, while those with service-connected disabilities may receive an exemption of $31,565.

3. Homestead Exemption

This exemption reduces the taxable value of a primary residence. Homeowners must meet specific criteria to qualify.

Tips for Managing Property Taxes

Managing property taxes effectively can help you avoid unexpected financial burdens. Here are some tips to consider:

1. Review Your Assessment

Regularly check your property assessment to ensure it reflects the current market value. If you believe it is too high, you can request a review or appeal.

2. Take Advantage of Exemptions

Explore all available exemptions and deductions to lower your tax bill. This includes senior citizen, veteran, and homestead exemptions.

3. Plan Ahead

If you’re planning to buy or sell a home, factor in property taxes when calculating your budget. This will help you make informed decisions and avoid surprises.

Conclusion

Clackamas County property tax is an important consideration for homeowners in the area. Understanding the factors that influence tax rates, how to calculate your bill, and the available exemptions can help you manage your finances more effectively. By staying informed and proactive, you can ensure that your property taxes remain manageable and predictable.

Meta Title: US Trending News: Clackamas County Property Tax Guide

Meta Description: Learn about Clackamas County property tax rates, how they compare to Oregon, and tips for managing your tax obligations. Stay informed with the latest news on US property taxes.

Author: John Smith

Title/Role: Real Estate Analyst

Credentials: John Smith is a certified real estate analyst with over 10 years of experience in property taxation and housing policy. He specializes in helping homeowners understand and manage their property tax liabilities.

Profile Link: www.johnsmithrealestate.com

Sources:

– Clackamas County Assessor’s Office

– Oregon Department of Revenue

– U.S. Census Bureau

Internal Links:

– Understanding Property Tax in Oregon

– How to Appeal a Property Tax Assessment

– Top Cities in Clackamas County

Schema Markup:

{

"@context": "https://schema.org",

"@type": "Article",

"headline": "Understanding Clackamas County Property Tax: A Complete Guide for Homeowners",

"description": "Learn about Clackamas County property tax rates, how they compare to Oregon, and tips for managing your tax obligations.",

"author": {

"@type": "Person",

"name": "John Smith"

},

"publisher": {

"@type": "Organization",

"name": "Real Estate Insights",

"logo": {

"@type": "ImageObject",

"url": "https://www.realestateinsights.com/logo.png"

}

},

"datePublished": "2025-04-05"

}

Featured Snippet:

Clackamas County property tax averages $2,814 annually, based on a median home value of $331,100 and a 0.85% tax rate. The county ranks 9th in Oregon for property tax rates, with a 0.91% rate, slightly above the state average.

CTA:

Stay updated with the latest news on property taxes and homeownership in Clackamas County. Explore our resources today!

URL Slug: clackamas-county-property-tax-guide

Image Optimization:

–

–

–

–

–

More Stories

US Trending News: Adam Brody’s Kids: All About the Actor’s Family Life

US Trending News: Affiliate Secrets Review

US Trending News: Everything You Need to Know About the Air Show in Jacksonville Beach