Mortgage rates have been a hot topic for homebuyers and sellers alike, especially as the housing market continues to evolve. With the average 30-year mortgage rate recently dropping to 7.22%, there’s a growing sense of optimism among those looking to purchase or refinance a home. However, it’s important to understand how these rates are influenced by broader economic factors and what they mean for your financial decisions.

Understanding the Current Mortgage Rate Landscape

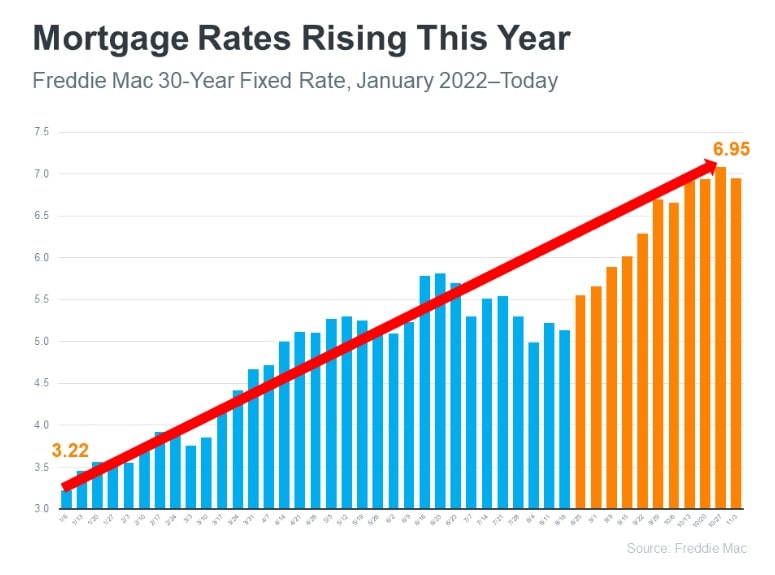

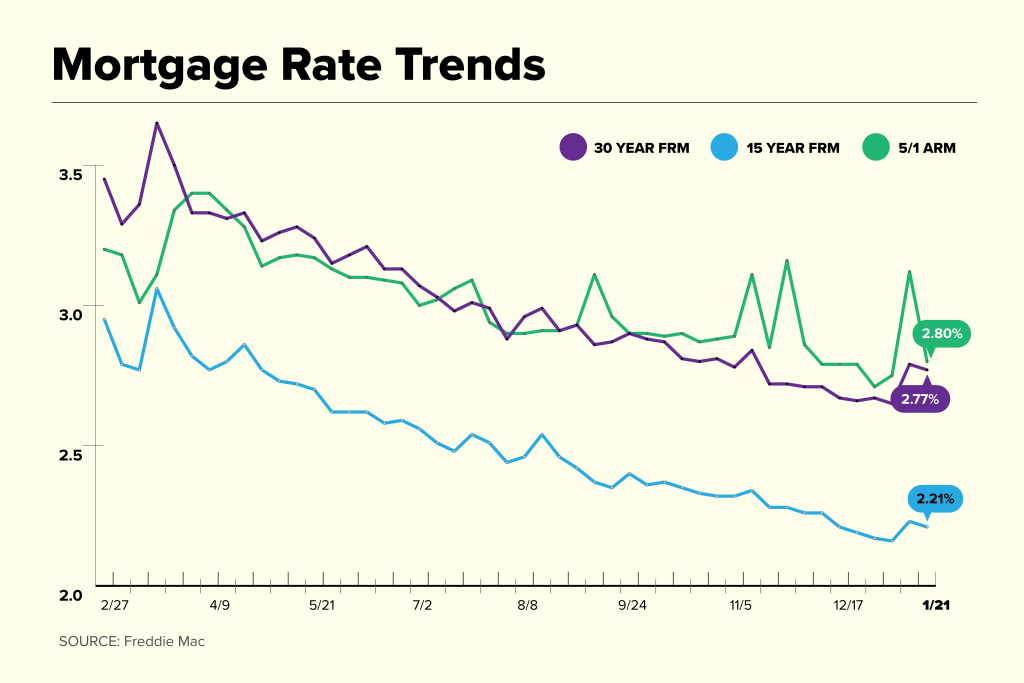

As of the latest data from Freddie Mac, the average 30-year fixed-rate mortgage has decreased to 7.22%, marking the fifth consecutive week of declines. This is a significant shift from the previous week’s rate of 7.29% and even further from the 6.49% recorded a year ago. While this drop is encouraging, it’s still much higher than the historically low rates seen during the early stages of the pandemic, which were around 3%.

The decline in mortgage rates can be attributed to several factors, including a shift in market sentiment and a decrease in the 10-year Treasury yield. The 10-year Treasury yield, which lenders often use as a benchmark for setting mortgage rates, has fallen to 4.32% as of midday trading on Thursday. This is a notable drop from its peak earlier this year, when it surpassed 5%, the highest level since 2007.

Factors Influencing Mortgage Rates

Mortgage rates are not set by a single entity but are instead influenced by a variety of economic and market-driven factors. Here are some key elements that impact mortgage rates:

-

Federal Reserve Policy: The Federal Reserve’s decisions on the federal funds rate play a crucial role in shaping mortgage rates. When the Fed raises interest rates, mortgage rates typically follow suit, and vice versa.

-

Inflation Trends: Inflation affects the purchasing power of money over time. Higher inflation can lead to increased mortgage rates as lenders seek to maintain returns on their investments.

-

Employment Data: Strong job growth and low unemployment figures can signal a robust economy, potentially leading to higher mortgage rates. Conversely, weaker employment reports may result in lower rates.

-

Gross Domestic Product (GDP): GDP growth reflects the overall health of the economy. A growing economy can lead to higher mortgage rates due to increased demand for homebuying.

-

Housing Market Conditions: The supply and demand for homes also influence mortgage rates. A tight housing market with limited inventory can drive up prices and, consequently, mortgage rates.

-

Bond Market Performance: Mortgage rates are closely tied to the yields on U.S. Treasury bonds. When bond yields rise, mortgage rates tend to follow, and vice versa.

How to Navigate the Mortgage Rate Environment

For homebuyers and refinancers, understanding the current mortgage rate environment is essential. Here are some strategies to consider:

1. Monitor Market Trends

Stay informed about economic indicators and market trends that could affect mortgage rates. Regularly check reliable sources such as Freddie Mac, the Mortgage Bankers Association, and financial news outlets to stay ahead of potential rate changes.

2. Lock in Your Rate at the Right Time

Once you find a favorable rate, consider locking it in to protect yourself from potential increases. A rate lock typically secures your rate for a specific period, usually 30 to 60 days. Be aware of any fees associated with locking in a rate and explore options like float-down clauses if available.

3. Compare Multiple Offers

Mortgage rates can vary significantly between lenders. Take the time to compare offers from multiple lenders to find the best deal. Consider not just the interest rate but also the loan terms, fees, and overall cost.

4. Improve Your Credit Score

A higher credit score can help you qualify for better mortgage rates. Pay your bills on time, reduce debt, and avoid new credit inquiries before applying for a mortgage.

5. Consider a Larger Down Payment

Putting more money down can lower your loan-to-value (LTV) ratio, which may result in a better interest rate. A larger down payment can also reduce the amount of private mortgage insurance (PMI) you may need to pay.

The Impact of Mortgage Rates on Homebuyers

While the recent decline in mortgage rates is positive news, it’s important to recognize the broader implications for homebuyers. Higher rates can significantly increase monthly payments, making homes less affordable for many Americans. For example, a 30-year mortgage at 7.22% would result in a monthly payment of approximately $2,199, compared to $1,800 at a 6% rate.

Moreover, the current housing market remains challenging due to a limited supply of homes. Sales of previously occupied homes have slowed, with a 20.2% decline through the first 10 months of the year compared to the same period in 2022. This lack of inventory has contributed to rising home prices and increased competition among buyers.

Tips for Homebuyers and Refinancers

If you’re considering buying a home or refinancing your current mortgage, here are some additional tips to keep in mind:

-

Work with a Professional: A knowledgeable real estate agent or mortgage advisor can provide valuable guidance and help you navigate the complexities of the mortgage process.

-

Understand Loan Options: Explore different types of mortgages, such as fixed-rate and adjustable-rate mortgages (ARMs), to determine which option best suits your financial situation.

-

Review Closing Costs: Be aware of all closing costs, including appraisal fees, title insurance, and other lender fees. These can add up and impact your overall expenses.

-

Plan for the Long Term: Consider how long you plan to stay in your home when choosing a mortgage term. A longer-term mortgage may offer lower monthly payments but result in more interest over time.

Conclusion

The current mortgage rate environment presents both opportunities and challenges for homebuyers and refinancers. While the recent decline in rates is a positive development, it’s essential to remain informed and strategic in your approach. By understanding the factors that influence mortgage rates and taking proactive steps to secure the best deal, you can make more confident and informed decisions in today’s housing market.

Stay updated with the latest news and trends in the mortgage industry to ensure you’re well-prepared for any changes that may affect your financial goals.

More Stories

67 Emote Clash Royale Emote: Complete List and Guide

What Is the 504 Gateway Timeout Error and How to Fix It?

US Trending News: 67 Emote Clash Royale QR Code: How to Use and Where to Find It