In today’s ever-evolving real estate market, understanding home interest rates is more crucial than ever. Whether you’re a first-time homebuyer or considering refinancing, staying informed about current mortgage rates can make a significant difference in your financial planning. This article provides an in-depth look at the latest trends in home interest rates, how they are determined, and what steps you can take to secure the best possible rate.

Understanding Today’s Mortgage Rates

As of the most recent data from Freddie Mac and Zillow, mortgage rates have shown some fluctuations this week, with slight decreases in certain categories. The average 30-year fixed-rate mortgage now stands at 6.17%, while the 15-year fixed-rate mortgage has dropped to 5.41%. These numbers reflect a broader trend where rates have been relatively stable but still lower compared to the same period last year.

Here are the latest figures for various mortgage types:

- 30-year fixed: 6.13%

- 20-year fixed: 5.78%

- 15-year fixed: 5.39%

- 5/1 ARM: 6.34%

- 7/1 ARM: 6.48%

- 30-year VA: 5.54%

- 15-year VA: 5.29%

- 5/1 VA: 5.61%

These rates are national averages and rounded to the nearest hundredth. It’s important to note that individual lenders may offer slightly different rates based on location, credit score, and other factors.

How Mortgage Rates Work

Mortgage rates are typically divided into two main types: fixed-rate and adjustable-rate mortgages (ARMs). A fixed-rate mortgage locks in your interest rate for the entire term of the loan, offering stability and predictability. An adjustable-rate mortgage, on the other hand, starts with a lower introductory rate that adjusts periodically after an initial fixed period, such as 5/1 or 7/1 ARMs.

The key difference between these two options lies in their long-term cost and flexibility. While fixed-rate mortgages provide consistent payments, ARMs may offer lower initial rates but carry the risk of future increases.

What Influences Mortgage Rates?

Mortgage rates are influenced by a combination of factors you can control and factors you cannot. Here’s a breakdown of both:

Factors You Can Control:

- Credit Score: Higher credit scores often lead to lower interest rates.

- Down Payment: A larger down payment reduces the loan-to-value ratio, potentially lowering your rate.

- Loan Type: Different loan programs (e.g., conventional, FHA, VA) come with varying rates.

- Home Use: Primary residences typically qualify for lower rates than investment properties.

Factors You Cannot Control:

- Economic Conditions: Strong economic growth often leads to higher rates, while weaker economies may result in lower rates.

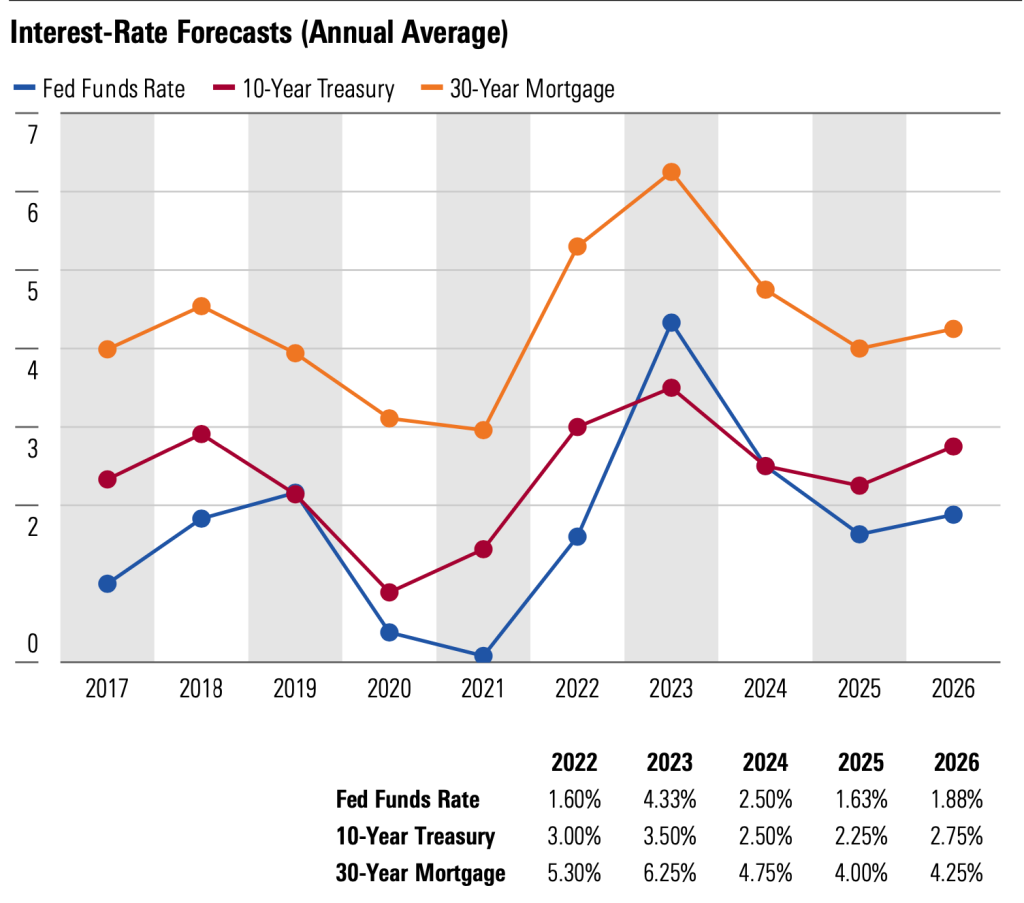

- Federal Reserve Decisions: The Fed’s monetary policy impacts short-term interest rates, which can influence long-term mortgage rates.

- Housing Market Trends: A competitive housing market may drive up rates due to increased demand.

Refinance Rates: What You Need to Know

Refinancing can be a smart move if you want to lower your monthly payments or reduce the total interest paid over the life of your loan. However, refinance rates are typically slightly higher than purchase rates due to the additional costs involved in the process.

According to the latest Zillow data, the current refinance rates are:

- 30-year fixed: 6.28%

- 20-year fixed: 5.84%

- 15-year fixed: 5.69%

- 5/1 ARM: 6.74%

- 7/1 ARM: 6.72%

- 30-year VA: 5.74%

- 15-year VA: 5.53%

- 5/1 VA: 5.68%

While these rates are close to purchase rates, it’s essential to factor in closing costs and your break-even point before deciding to refinance.

Tips for Getting the Best Mortgage Rate

To ensure you get the lowest possible mortgage rate, consider the following strategies:

- Shop Around: Compare offers from multiple lenders to find the best deal.

- Improve Your Credit Score: A higher credit score can lead to better rates.

- Increase Your Down Payment: A larger down payment reduces risk for lenders.

- Consider a Shorter Loan Term: A 15-year mortgage usually comes with a lower interest rate than a 30-year mortgage.

- Lock in Your Rate Early: If you see a favorable rate, consider locking it in to avoid potential increases.

Frequently Asked Questions About Mortgage Rates

What is the lowest-ever mortgage rate?

The lowest-ever 30-year fixed mortgage rate was 2.65%, recorded in January 2021. Rates are unlikely to dip below 3% anytime soon.

Is 2.75% a good mortgage rate?

Yes, 2.75% is an excellent rate, though it’s rare to find such low rates in today’s market unless through an assumable mortgage.

At what rate should you refinance?

Experts suggest refinancing when you can lock in a rate that is at least 1% lower than your current rate. However, this depends on your financial goals and break-even point.

Conclusion: Stay Informed and Make Smart Choices

Understanding today’s home interest rates is essential for making informed decisions about buying or refinancing a home. With rates fluctuating based on economic conditions and lender policies, it’s crucial to stay updated and compare offers from multiple sources.

Whether you’re looking to secure a new mortgage or explore refinancing options, taking the time to research and understand the market can save you thousands of dollars over the life of your loan. Always consult with a trusted mortgage professional to tailor the best strategy for your unique situation.

Author: Sarah Mitchell

Title/Role: Real Estate and Finance Analyst

Credentials: With over a decade of experience in the real estate industry, Sarah has helped hundreds of homebuyers and homeowners navigate the complexities of mortgage rates and financing. She holds a degree in Economics and is a certified mortgage specialist.

Profile Link: Sarah Mitchell Profile

Sources:

– Freddie Mac

– Zillow

– NerdWallet

Internal Links:

– How to Compare Mortgage Lenders

– Mortgage Refinance Guide

– Mortgage Payment Calculator

Featured Snippet:

“Current home interest rates have seen slight declines this week, with the 30-year fixed rate at 6.17%. Understanding these rates is crucial for homebuyers and refinancers.”

Call to Action:

Stay updated with the latest news and insights on home interest rates by visiting our website regularly. Explore today’s headlines and make informed financial decisions.

URL Slug: us-trending-news-home-interest-rates

Image Optimization:

–

–

–

–

–

Schema Markup:

{

"@context": "https://schema.org",

"@type": "Article",

"headline": "US Trending News: Current Home Interest Rates Today",

"datePublished": "2025-11-01",

"author": {

"@type": "Person",

"name": "Sarah Mitchell"

},

"publisher": {

"@type": "Organization",

"name": "Your Website Name",

"logo": {

"@type": "ImageObject",

"url": "https://yourwebsite.com/logo.png"

}

}

}

More Stories

US Trending News: Affiliate Secrets Review

US Trending News: Understanding Alameda County Property Tax

Understanding Alameda Property Tax: A Complete Guide for Homeowners